Another round of volatility – this is how the US stock indexes have been performing today. Despite the positive economic data which came out a couple of hours ago, the US stock markets tanked in the first half of the trading session.

At the beginning of the trading session the numbers for Durable Orders came out, which showed an increase of 0.1%, while the market expected an increase of 0.5%. A couple of hours ago, the data for New Home Sales was released showing 421 thousand new sales in August which is higher than market’s expectations.

The US benchmark indexes swayed between these two fundamental news unable to take a firm direction. To a certain extent, this is a reflection of the market’s uncertainty towards Fed’s policy.

While the benchmark indexes are oscillating up and down from the previous close, the OTC Markets have been firmly on bearish land since today’s opening bell. Thus, currently the OTCM ADR Index is down 0.16% at 1,512.77 points.

Despite the current decline of the OTC Markets there are several penny stock market movers today that can become an object for speculation:

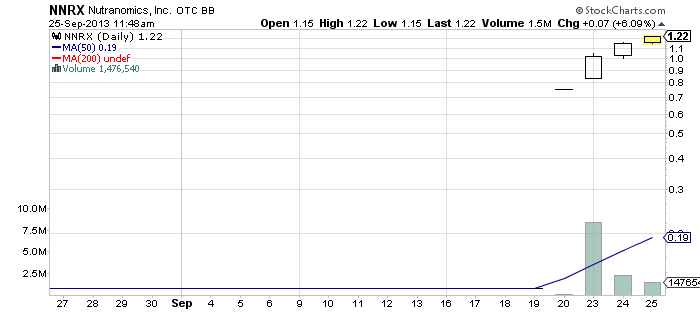

Nutranomics, Inc. (NNRX) – NNRX has been flying up since the change of its stock symbol, which marked the recent reverse acquisition by Health Education. The stock has also been one of the top market movers on the OTCQB markets in the last couple of days.

Nutranomics, Inc. (NNRX) – NNRX has been flying up since the change of its stock symbol, which marked the recent reverse acquisition by Health Education. The stock has also been one of the top market movers on the OTCQB markets in the last couple of days.

Today, NNRX continues the up move. At the moment shares of the company’s common stock are trading 5% higher at $1.21 per share on a volume of 1.4 million. Until this moment the number of NNRX shares which changed hands equals a dollar volume of $1.75 million.

Today, NNRX continues the up move. At the moment shares of the company’s common stock are trading 5% higher at $1.21 per share on a volume of 1.4 million. Until this moment the number of NNRX shares which changed hands equals a dollar volume of $1.75 million.

Today, NNRX provided fundamental support for its stock by issuing a press release, which announced that the company had scheduled a meeting with Unlimited Network of Opportunities (UNO), a multi-level marketing company in the Philippines. NNRX said that this meeting was part of the company’s current reenergized expansion into the Asian market.

NNRX has reached a market capitalization of $53 million thanks to a significant overseas support. However, it will take some time before we can see whether the company will manage to meet or fall short of its shareholders’ expectation.

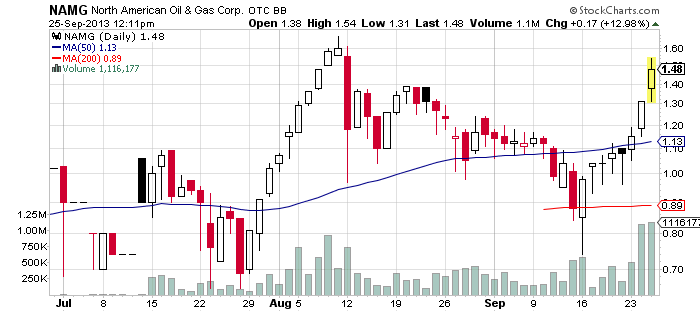

North American Oil & Gas Corp. (NAMG) – NAMG is another green colored market mover on the OTC Markets today. The stock has been heading up since the start of the week and yesterday it registered a very strong trading session, following a corporate update issued by the company.

North American Oil & Gas Corp. (NAMG) – NAMG is another green colored market mover on the OTC Markets today. The stock has been heading up since the start of the week and yesterday it registered a very strong trading session, following a corporate update issued by the company.

Yesterday, NAMG announced that it had completed an exhaustive analysis on the recently acquired 3D survey covering its 3,429 acres Tejon Area totals. The announcement resulted in an increased buying pressure on NAMG stock, which finished the trading session 14% higher at $1.31 per share on a trading volume of 1 million.

Yesterday, NAMG announced that it had completed an exhaustive analysis on the recently acquired 3D survey covering its 3,429 acres Tejon Area totals. The announcement resulted in an increased buying pressure on NAMG stock, which finished the trading session 14% higher at $1.31 per share on a trading volume of 1 million.

The increased interest towards NAMG stock persists today as the company has been enjoying another round of buying pressure since the opening bell. Currently shares of NAMG stock are trading 13% higher at $1.48 per share on a higher than average volume of 1.1 million.

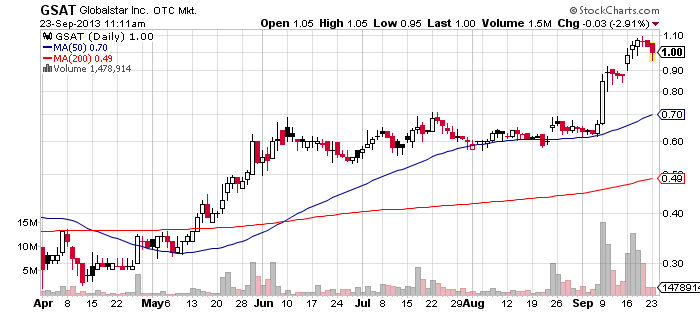

Globalstar, Inc. (GSAT) – GSAT continues its correction phase today but at a much lesser speed. Speculators targeting GSAT feel insecure, as the stock has not received any significant fundamental support for the last couple of days.

Globalstar, Inc. (GSAT) – GSAT continues its correction phase today but at a much lesser speed. Speculators targeting GSAT feel insecure, as the stock has not received any significant fundamental support for the last couple of days.

The last announcement of the company, which concerned the participation of GSAT in Imperial Capital’s 2013 Global Opportunities Conference, was not met with much excitement, as on the same day the stock went down 1% on a higher than average volume of 6.5 million.

The last announcement of the company, which concerned the participation of GSAT in Imperial Capital’s 2013 Global Opportunities Conference, was not met with much excitement, as on the same day the stock went down 1% on a higher than average volume of 6.5 million.

Since Thursday last week, GSAT has switched into a correction mode. Today, the stock has slowed the decline and is currently testing the psychological $1.00 mark. At the moment shares of GSAT stock are trading 0.40% lower at $0.10 per share on a lower than average volume of 1.1 million.

Given that the trading volume continues to decline, this may mean that GSAT will start having problems with sustaining its market capitalization of $407 million.

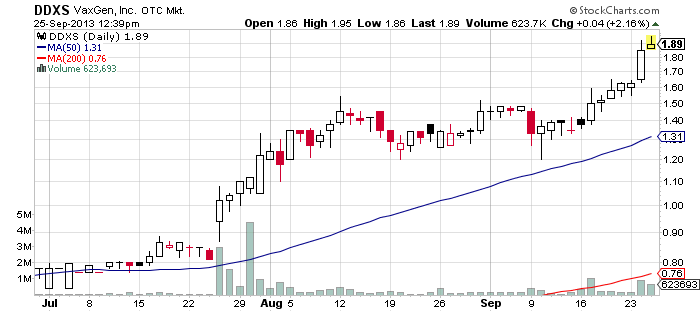

diaDexus, Inc. (DDXS) – DDXS is also figuring in the list of the most actively traded stocks on the OTCQB markets today. The company has just hit a new 52-week high after generating a modest buying pressure during the first half of today’s trading session.

diaDexus, Inc. (DDXS) – DDXS is also figuring in the list of the most actively traded stocks on the OTCQB markets today. The company has just hit a new 52-week high after generating a modest buying pressure during the first half of today’s trading session.

The reasons for the recent surge of DDXS seem unclear at the moment, as the stock has been soaring without any fundamental or promotional support. Yesterday, for example, the value of DDXS stock increased 14% to $1.85 per share on a higher than average volume of 900 thousand.

The reasons for the recent surge of DDXS seem unclear at the moment, as the stock has been soaring without any fundamental or promotional support. Yesterday, for example, the value of DDXS stock increased 14% to $1.85 per share on a higher than average volume of 900 thousand.

DDXS has been in a clear uptrend since mid-July. Since then the value of the company’s shares have increased 140%. Today the stock registered a new 52-week high and at the moment shares of the company’s stock are trading 2% higher at $1.89 per share on a higher than average volume of 623 thousand.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.