SIGN UP FOR YOUR EXCLUSIVE FREE STOCK ALERTS

Email-subscribtion

By submitting your email, you agree to our Privacy Policy and Disclaimer.

Swing Trading

Introduction

Although sometimes confused, swing trading and day trading are completely different animals. Whereas a day trader usually will open and close a position within the same trading day, a swing trader places his focus less on the fundamentals of the stock, (frankly they don’t even care what the name of the company is) and more on the momentum of the price. There is no definitive time a swing trader stays in a position and the time from entry to exit varies from 3 days to 4 weeks, however, most swing traders open and close their positions within 3-7 days.

Swing trading is a perfect strategy for small at-home traders as making a quick gain from swing trading takes quick and sudden action to open and close your positions. It is nearly impossible for large institutional or commercial traders to participate as they must acquire and liquidate large blocks of a security, which takes time to execute. As a relatively small trader you are in a position to ride the wave of the price momentum of a stock. Swing trading can also be advantageous for part time traders who can’t sit and watch the trading monitors all day, but still want to participate in trading.

Swing Trading on the Panny Stock Market

One of the most widely used tactics for successful swing trading is called Fibonacci Retracements. Fibonacci in its simplest form is a series of numbers that when you add the previous two numbers together, it equals the next number. For example:

Microcap stocks (aka Penny Stocks) are a perfect vehicle for swing trading strategies. These stocks trade within a volatile realm and this volatility creates opportunities for swing traders to quickly manifest a profit in a relatively short time period. However, this type of trading also occurs best in stable and stagnate markets, but where the owned security is showing volatility and therefore opportunities for profit.

Many investors recommend swing trading with large-cap stocks like Cisco or Intel. These companies are reliable and trend slowly enough that amateur traders can identify trends and capitalize on them. All the same, it’s also possible for penny stocks. The trick is simply to limit exposure (i.e. don’t risk too much) and to shorten the trading period to two or three days at most.

Swing Trading strategies : Fibonacci

One of the most widely used tactics for successful swing trading is called Fibonacci Retracements. Fibonacci in its simplest form is a series of numbers that when you add the previous two numbers together, it equals the next number. For example:

2, 4, 6, 10, 16, 26, 42, 68…etc.

Fibonacci retracements usually are denoted at 38.2%, 50% and 61.8%. When a stock peaks, these numbers identify the pull back and possible reversal. A trader should begin to look for a reversal upward at the 38.2% level. This is by no means a guarantee and should be confirmed with a candlestick chart and other indicators. If the candlestick and other indicators do not show reversal indicators, then wait until the stock reaches the 50% level. Again check the candlestick and other indicators to see if a reversal or buy signal is apparent. If no alternative signals are present again, watch the stock until the 61.8% level.

Let’s look at a simple chart to display this concept:

As the price of the stock begins to rise to its first peak (level A), it then retraces back 38.2% (level B), before it reverses again. The next two diagrams show the 50% and 61.8% levels. When the proverbial stars are aligned with candlestick and other indicators, Fibonacci Retracements can signal a trend reversal, allowing a trader a lower risk entry into a position and a nice profit.

Swing Trading Strategies : Trading the Gaps

Another popular strategy for swing trading is called “trading the gaps”. A gap occurs when there is movement in price when no measurable trading occurred. The most common and easily understood type of gap is when a stock closes at one price at the end of trading, but open the following day at a different price. This type of gap is caused by unfilled buy or sell orders placed before the opening bell which causes the new trading session to start at a different price point.

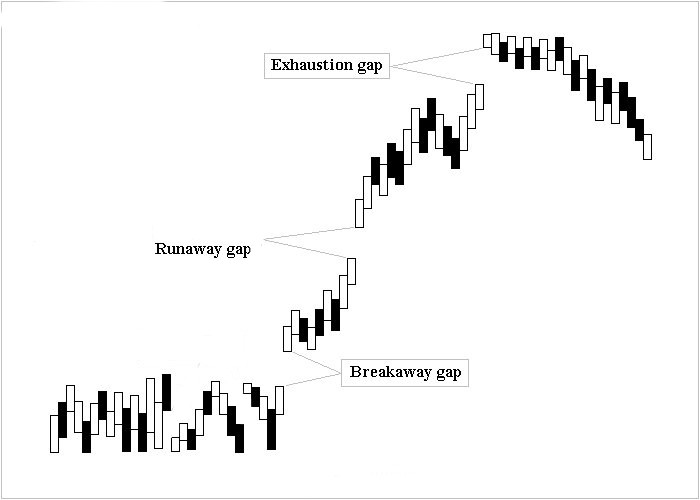

There are three main types of gaps identified by traders:

- Breakaway Gaps – A breakaway gap occurs when the price of the security has been trading with little or no change and then, without warning, will “breakaway” in a direction.

- Continuation Gaps – A continuation gap is also referred to as a runaway gap and occurs when prices are rapidly trending up. The trend simply “continues”.

- Exhaustion Gaps – The exhaustion gap represents the last push from buyers or sellers to squeeze the last profit from a trade before a trend reversal occurs.

Before you use gaps as a swing trading strategy, you must understand that there are two categories of gaps, Professional gaps and Novice gaps (aka Amateur). A novice gap represents a change up or down from buyers who are attempting to jump on board as the price is trending in a direction. In essence, they are too late to the party and by time the trade is made the institutional and commercial traders have already made their profit and are preparing to exit their positions. A professional gap is defined as a gap, which occurs after a price trend is present, in the opposite direction of this price trend. Usually these gaps occur at the breakaway of the price, whereas a novice gap moves in the direction of the price trend and occurs over several periods.

A trader will have much greater success following the professional gap and will get burned frequently trading a novice gap. You can usually determine the difference in the gap by identifying the timing and often by using Level II data to identify who is buying or selling a high volume of the stock. Identifying gaps and the reason behind the sudden change in price is an excellent way for swing traders to profit in a relatively short time period.

Conclusion

Swing trading, no matter whether with large-cap or penny stocks, is akin to short term range trading whereby the trader rides a wave of momentum within a specified range for a short term. Market timing and generally high volumes are the most important elements of swing trading. Often times, stocks will pull back before a trend reversal appears and after this consolidation, swing trading opportunities may be present. Stochastics, Bollinger bands, candlesticks and momentum, among other indicators, are useful when debating the timing of entering and exiting your position. As discussed above, use the Fibonacci retracements in combination with a candlestick chart to verify a trend reversal up (when you are long) and the timing of your entry and exit in a position to ensure a nice profit.

Free Membership

Sign-up for this top rated Penny Stock Newsletter

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.