Top Promoted OTC Markets Securities: OCFN, AQUM

The US stock markets rallied yesterday, as investors believed that US politicians would reach a deal for the country’s debt at the end of the day. Indeed, after long and intensive negotiations the House of Representatives accepted the Senate’s measures against the fiscal crisis.

However, the US debt problem was not solved but only postponed for a couple of months, after which it will once again get into the spotlight of news and investors. This is why it will not be surprising if the markets continue to act reservedly in the short term.

The OTC Markets have been following the general trend in the last couple of days, so yesterday they also rallied. The OTCM ADR Index finished the last trading session 0.74% higher at 1,528.50 points.

One hour before today’s trading session it was announced that last week the number of Initial Jobless Claims had decreased to 358 thousand as compared with 373 thousand for the week before. However, the numbers are higher than market’s expectations by nearly 30 thousand. This news will probably affect the attitude of market players in the forthcoming trading session.

Penny stock traders will also have to bear in mind the stock promotions which have been issued since the last closing bell as they may also affect the trading session on the OTC Markets.

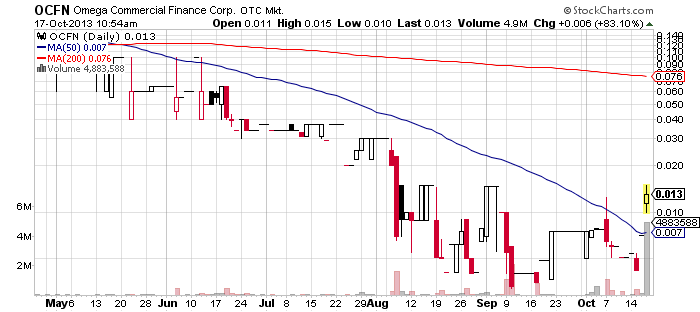

Omega Commercial Finance Corp. (OCFN) – OCFN is the most intensively promoted penny stock today. Online databases show that the company has been touted by a total of fifteen different paid newsletters.

Omega Commercial Finance Corp. (OCFN) – OCFN is the most intensively promoted penny stock today. Online databases show that the company has been touted by a total of fifteen different paid newsletters.

Unfortunately, none of the promoters had disclosed the third party sponsoring the campaign. Nevertheless, the newsletters’ fine print shows that the promoters leading the campaign on OCFN had received a compensation of $20,000.

A company called Omega Finance Corp. had sponsored the previous two promotions on OCFN which took place on Oct 15 and Oct 07. Historical data shows that OCFN stock performed very negatively on these two dates.

A company called Omega Finance Corp. had sponsored the previous two promotions on OCFN which took place on Oct 15 and Oct 07. Historical data shows that OCFN stock performed very negatively on these two dates.

Thus, on Oct 07 OCFN stock value fell 17% on a higher than average volume of 1 million and on Oct 15 OCFN went down 22% on a higher than average volume of 350 thousand. These campaigns, however, were based on only one singular newsletter, for which the third party had paid $5,000.

Today, the company is much more intensively promoted, so it was not surprising that OCFN has generated a record high trading volume of 4 million since the start of the trading session. In addition the share price of OCFN stock is currently 69% higher than the previous close.

So far OCFN has not backed up its promotional campaign by a press release. The last news which came from the company dates back to August 06, when OCFN announced that CCRE Capital LLC had executed loan documents with Cayjam Development Limited providing them with a five-year $170.5 million construction line of credit.

Despite this announcement, the company’s share value decreased from $0.03 to $0.007 per share over the last two months. Today the promotional campaign on OCFN managed to inflate the share value to $0.013 per share but the ability of the company to maintain this value seems very speculative.

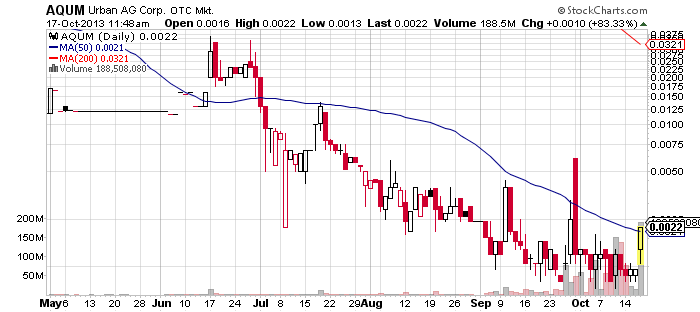

Urban Ag Corp. (AQUM) – AQUM is featured in one of the highest paid promotions for today. The new campaign on AQUM had cost a total of $41,000, according to online databases.

Urban Ag Corp. (AQUM) – AQUM is featured in one of the highest paid promotions for today. The new campaign on AQUM had cost a total of $41,000, according to online databases.

The promotion is led by a couple of penny stock promoters, among which Stock Mister, 24-7 Stock Alert, and Stock Palooza. Online records have also spotted two third parties in the current campaign on AQUM – Flip Ventures LLC and Bonjour Capital LLC.

Apart from the promotional support, AQUM stock has also been backed up by a corporate press release which was issued by the company earlier today. AQUM officially announced that B&R Telephone, an operating unit of its wholly-owned subsidiary Green Wire Enterprises Inc., has been awarded a voice/data/networking contract and service Agreement from the owner of over 575 Stripe’s Convenience Stores located in Texas, New Mexico and Oklahoma.

Apart from the promotional support, AQUM stock has also been backed up by a corporate press release which was issued by the company earlier today. AQUM officially announced that B&R Telephone, an operating unit of its wholly-owned subsidiary Green Wire Enterprises Inc., has been awarded a voice/data/networking contract and service Agreement from the owner of over 575 Stripe’s Convenience Stores located in Texas, New Mexico and Oklahoma.

The market awareness campaign along with the corporate update managed to stir investors’ interest toward AQUM, so that the stock is currently under heavy buying pressure. Therefore, at the moment shares of AQUM stock are trading 67% higher at $0.002 per share on a higher than average volume of 200 million.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.