Today, it looks like US markets are going to deliver a rather volatile session, as the benchmark indexes are reacting unstably at the just released key economic data. The Retail Sales statistics show an increase of 0.2%, which is exactly what market analysts expected, yet there has been a decline of 0.4% as compared with the previous month.

On this basis, the correction of the US benchmark indexes continues. However, the situation on the OTC Markets is quite different, as the OTCM ADR Index is still floating above the previous close and at the moment it is trading 0.04% higher at 1,453.38.

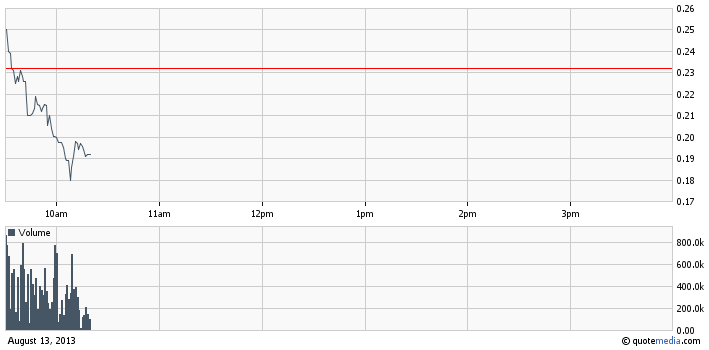

Medical Marijuana, Inc. (MJNA) – MJNA is currently falling down under the gravity force of a heavy selling pressure. MJNA started today’s trading session above the previous close but this was only an episodic moment, so a couple of minutes later the stock plunged down sharply.

Medical Marijuana, Inc. (MJNA) – MJNA is currently falling down under the gravity force of a heavy selling pressure. MJNA started today’s trading session above the previous close but this was only an episodic moment, so a couple of minutes later the stock plunged down sharply.

At the moment shares of MJNA stock are trading 15% lower at $0.197 per share on a higher than average volume of 17 million. Today, investors are punishing MJNA stock after the company issued its most recent financial results covering the period between April and June 2013.

In a press release issued through Globe Newswire, MJNA announced that it had earned a net income of $6 million for the quarter ending June 30, 2013. In addition, the company commented that:

- It had managed to launch its marketing and sales division, HempMedsPX.

- It had acquired additional brands and over 20 products through Canipa Holdings

- It had relocated to a larger facility in July.

However, investors were unimpressed by the announced achievement, so MJNA stock found itself in the grip of a sharp correction spike which has almost wiped all the gain that the stock achieved yesterday after surging 34% on a much higher than average volume.

However, investors were unimpressed by the announced achievement, so MJNA stock found itself in the grip of a sharp correction spike which has almost wiped all the gain that the stock achieved yesterday after surging 34% on a much higher than average volume.

In fact, the sobering moment for investors came when they got the opportunity to peek into the very financial report of MJNA. There they could see that the announced net income of $6 million for the second quarter, was actually due to income from extraordinary items, whereas MJNA has actually incurred an operating net loss of $342 thousand.

This realization poured a bucket of cold water on investors’ heated passions towards the company’s stock, which resulted in MJNA drawing a huge red candlestick on the chart which extended down as far as the 200-MA.

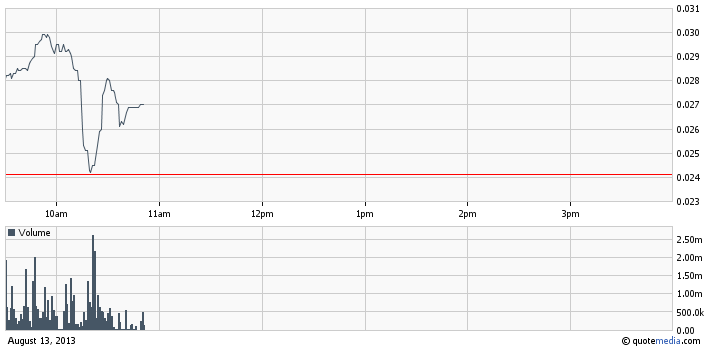

Cereplast, Inc. (CERP) – Today, CERP is one small green ray of light among the bearish storm that is currently troubling the OTCQB Market. CERP stock continues to climb confidently on the chart due to speculations about the company’s pending quarterly report.

Cereplast, Inc. (CERP) – Today, CERP is one small green ray of light among the bearish storm that is currently troubling the OTCQB Market. CERP stock continues to climb confidently on the chart due to speculations about the company’s pending quarterly report.

It was at the end of July when CERP gave the first teaser about its financial performance, stating in a press release that “revenue for the first 6 months of 2013 experienced major growth, with the expected number to top approximately $1.7MM compared to about $0.2MM in 2012, reflecting a nearly 800% increase.”

Several days later when CERP announced a conference call regarding its second quarter 2013 results, the demand for the stock soared which launched CERP stock from $0.015 to today’s intraday high at $0.03 per share.

Several days later when CERP announced a conference call regarding its second quarter 2013 results, the demand for the stock soared which launched CERP stock from $0.015 to today’s intraday high at $0.03 per share.

A couple of hours ago, CERP issued another press release which contained an outlook on the bioplastic industry over the next five years and the company’s growth opportunity within this market. This press release was enough to maintain the hype around CERP stock, so it is once again facing a lot of buying pressure on the OTCQB Market.

Currently shares of CERP stock are trading 12% higher at $0.027 per share on a much higher than average volume of 14.7 million. However, as the general mood on the US Markets today is bearish, it is possible that CERP demonstrate more volatility than usual.

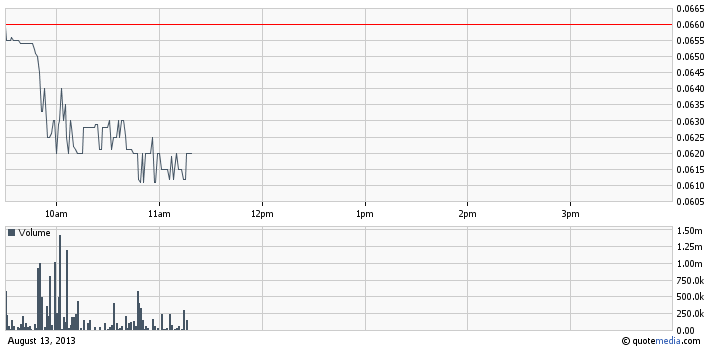

Advanced Cell Technology, Inc. (ACTC) – ACTC stock has been seriously pummeled for the last couple of trading sessions.

Advanced Cell Technology, Inc. (ACTC) – ACTC stock has been seriously pummeled for the last couple of trading sessions.

First, the company issued its most recent financial report last Wednesday with fiscal results being not so different than the previous quarter. This would have had a neutral effect on market players, had it not been for the strong bearish mood which has obsessed the major US stock markets in the last couple of days.

However, it was yesterday that ACTC gave a much more worrying sings of weakness as it declined 6% to $0,066 per share on a heavy trading volume. What spurred the sale out of ACTC stock was a press release which announced that ACTC has been considering:

- To increase the number of its authorized shares of common stock by 1 billion to 3.75 billion

- To enable a reverse stock split of between 1-for-30 and 1-for-100

In fact ACTC had already filed preliminary proxy materials with the SEC concerning this structural changes. Apparently, this news had a bad ring to penny stock traders, as it may mean that more dilution is looming on the horizon.

In fact ACTC had already filed preliminary proxy materials with the SEC concerning this structural changes. Apparently, this news had a bad ring to penny stock traders, as it may mean that more dilution is looming on the horizon.

These apprehension is obviously controlling investors today as well, as shares of ACTC continue to tank down during the current trading session. At the moment shares of ACTC stock are trading 7% lower at $0.061 per share on a higher than average volume of 14.8 million. The trading activity towards ACTC is so high today, that so far traders have turned over nearly $1 million in trade value, making ACTC one of the top market movers on the OTCQB market for Aug 13,2013.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.