Top Promoted OTC Markets Securities: AMPG, PTOO, AQUM

Yesterday, investors on the US stock market were not in favor of risk taking, especially after the US Minister of Finance, Jacob Liu, warned that the government was going to become insolvent in less than a month.

Thus, the US benchmark indexes fell down during the trading session. The OTC Markets followed the general trend and also posted a decline at the end of the day. The OTCM ADR Index finished 0.20% lower at 1,512.17 points.

Today, investors are going to pay a closer look to the US economic calendar, as information about a couple of important indexes are expected to come out, viz. Initial Jobless Claims and the US GDP.

Investors speculating with OTC Markets securities will also have to monitor the promotional activities which have been initiated after the last closing bell, as they may play a key role in the performance of certain stocks.

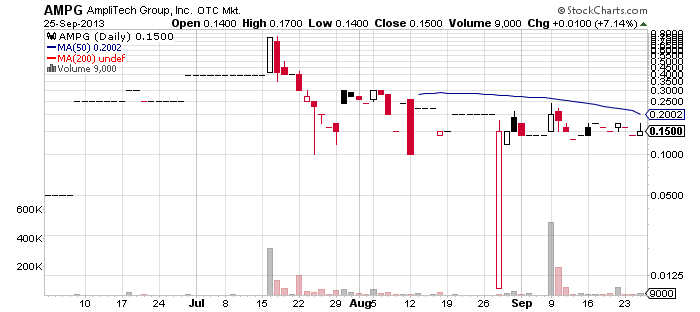

![]() Amplitech Group Inc. (AMPG) – The first target of penny stock promoters for today is AMPG. Online databases have registered four promotional letters touting the company today. The fine print of the newsletters revealed that the entities distributing the promo letters had received a compensation of $30,000 for the service.

Amplitech Group Inc. (AMPG) – The first target of penny stock promoters for today is AMPG. Online databases have registered four promotional letters touting the company today. The fine print of the newsletters revealed that the entities distributing the promo letters had received a compensation of $30,000 for the service.

Earlier this month, AMPG announced that it was in the process of developing a breakthrough technology that allowed cell towers to increase capacity and range significantly. The announcement was subsequently backed up by a trade alert issued by OTC Signal.

Earlier this month, AMPG announced that it was in the process of developing a breakthrough technology that allowed cell towers to increase capacity and range significantly. The announcement was subsequently backed up by a trade alert issued by OTC Signal.

As a result AMPG registered one of its most intensive trading day for the last couple of months. On that day, which happens to be Sept 9th, AMPG generated a trading volume of 507 thousand, which was more than 15 times higher than the monthly average. At the same time the price of AMPG shares rose 43% to $0.18.

However, this event was not potent enough to help the stock form a trend, so AMPG continued its consolidation phase. In fact, the stock has maintained a trading channel between 0.14 and 0.20 since mid-July.

On the last trading session, AMPG rose 7% to $0.15 per share but this happened on a way lower than average volume of 9,000. So far, AMPG hasn’t issued any new press releases but it is possible that this may happen until the opening bell in order for the company to support the initiated promotional campaign.

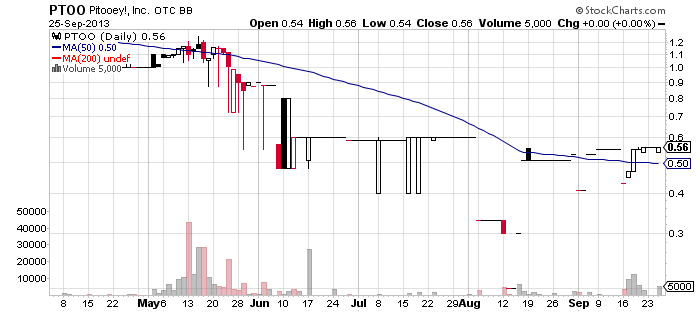

Pitooey!, Inc. (PTOO) – PTOO is today’s promo campaign which has involved the highest number of promoters. Online databases have recorded a total of 12 different newsletters dedicated on the company since the last closing bell.

Pitooey!, Inc. (PTOO) – PTOO is today’s promo campaign which has involved the highest number of promoters. Online databases have recorded a total of 12 different newsletters dedicated on the company since the last closing bell.

This campaign is backed up by several third parties, among which Investor News Source Consulting, Equities Awareness Group and one22 Media LLC. The third parties have provided a total compensation of $19,000 for the current marketing effort on PTOO.

This is not the first time the company gets promoted, though. The previous promotion of PTOO took place on Aug 19th but the campaign was a complete fiasco, as during the same day PTOO managed to generate a trading volume of only 500 while the share price remained flat. Naturally, the generated volume was below the monthly average, which is also a very low figure, viz. 1,700.

Apparently PTOO has been unable to become a popular stock among market speculators. PTOO stirred a little bit around Sept 17th when the company announced “strong financial results for Q2 2013”.

Apparently PTOO has been unable to become a popular stock among market speculators. PTOO stirred a little bit around Sept 17th when the company announced “strong financial results for Q2 2013”.

However, one must have a very sophisticated imagination in order to see the actual financial results reported in the last 10-Q of the company as “strong”. PTOO reported a gross profit of $43 thousand for the second quarter 2013. For the same period, however, the company had incurred a net loss of nearly $700 thousand, up from a net loss of $17 thousand the same quarter a year ago.

Today, the company issued another press release saying that its customer base had experienced a “rapid expansion”. The news release has obviously been released to aid the promotional efforts on the company.

In fact, since today’s campaign has been initiated on a large scale, there is a chance for the stock to attract more trading activity in the forthcoming trading session. However, it is harder for promoters to pump a company with a market cap of over $15 million, and PTOO is currently valued at $58 million. Therefore, even if PTOO generates a higher trading volume today, there is a chance for the stock to succumb to a higher selling pressure than usual.

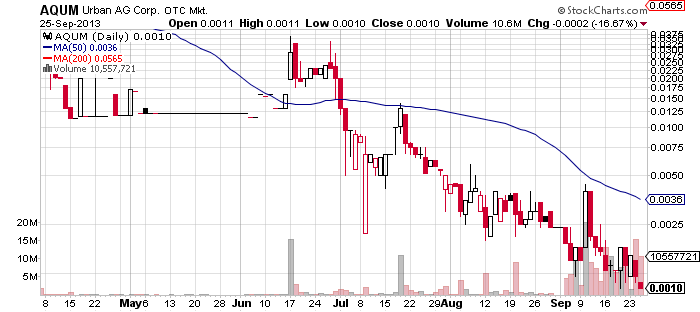

Urban Ag Corp. (AQUM) – AQUM is another company which is heavily promoted today. Online records show that AQUM has already been touted by eleven different newsletters since the last closing bell.

Urban Ag Corp. (AQUM) – AQUM is another company which is heavily promoted today. Online records show that AQUM has already been touted by eleven different newsletters since the last closing bell.

The numerous promoters who are advertising the company today have received a cumulative compensation of $11,000. However, most of the campaign’s sponsors remained anonymous.

AQUM, on its part, has also provided support for the marketing awareness campaign in the form a press release which was issued earlier today. The press release announced that AQUM had been awarded a microwave expansion project to install 28 microwave sites and related services for a tier one carrier in the Midwest.

AQUM, on its part, has also provided support for the marketing awareness campaign in the form a press release which was issued earlier today. The press release announced that AQUM had been awarded a microwave expansion project to install 28 microwave sites and related services for a tier one carrier in the Midwest.

The increased effort to popularize AQUM stock come at a very crucial moment, as the stock is at the psychological $0.001 mark, which is the entrance to the triple zeroes area. Definitely, it will be interesting for penny stock speculators to monitor how AQUM stock will react today, given the above mentioned circumstances.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.