Although Xumanii (OTCQB:XUII) is a company with a short name and trading history, it is certainly not short of intrigue. In fact XUII has become one of the most actively traded stocks on the OTC Markets thanks to a large-scale promotion of the stock.

Paid newsletters touting the company’s stock symbol have been flooding investors’ inboxes since the start of May. Online records show that a whole host of promoters have been engaged in this matter with names such as Penny Stock Psycho and Darth Trader standing on the front lines of the market awareness campaign.

As a result the demand for XUII stock increased high enough to bring about a three-digit jump in XUII shares’ value. On May 1st, the first day of the promotion, XUII soared 200% on an unprecedented volume of 37 million shares.

Thanks to those promoters who condescended to disclose their compensation it became apparent that the campaign had cost $500,000. The source of the compensation, however, was kept in deep secret.

On the following day market speculators decided it was a profit-taking time and as a result almost half of the stock value was wiped out during the trading session.

A couple of days after the promotion XUII added more fuel to the flames by issuing a press release that announced the acquisition of a master license to an IP portfolio described as “cutting-edge”. According to the company the acquisition would “significantly enhance” its current platform technology.

On the same day the market responded bullishly to this news by driving the stock 20% higher to $0.22 per share on a volume of 10 million shares. The next couple of days the stock was oscillating within a price channel defined between the 0.22 and 0.175 lines.

On the same day the market responded bullishly to this news by driving the stock 20% higher to $0.22 per share on a volume of 10 million shares. The next couple of days the stock was oscillating within a price channel defined between the 0.22 and 0.175 lines.

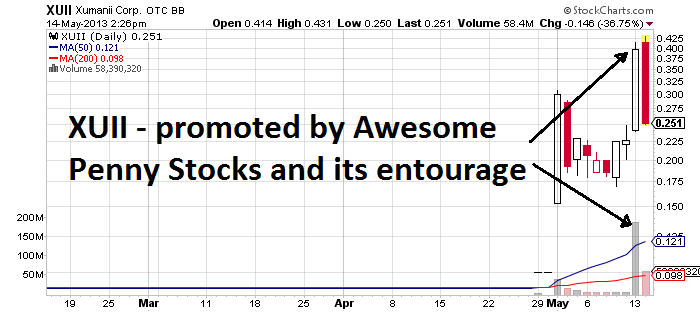

This Monday the attention of numerous penny stock speculators was fixed on XUII as the heavy artillery joined the market awareness campaign. What I mean is that on the same day another promotional wave hit the market, this time initiated by one of the most speculative names in the penny stock world – Awesome Penny Stocks and its crew of related promoters.

This caused XUII stock to explode both in volume and price. Thus, the number of shares which changed hands exceeded 188 million, which is five times higher than the volume achieved during the first promotion of the company. In addition, the price of XUII stock went up 75% to $0.397 after hitting an intraday high at $0.41.

It seems that investors are still intoxicated by the chant of the promoters as XUII keeps climbing up today. As we speak, XUII stock is trading at $0.42 per share which is 6% higher than the previous close. Apparently the headline “ Xumanii Could Mint Thousands of New Millionaires” devised by Awesome Penny Stocks is still flashing in many investors’ heads. (Note: By the time of publishing, XUII had crashed down 22%; apparently the bullish episode was only a brief prelude to what usually follows after a stock promotion)

However, the same heads may start aching once they see the real picture in the company’s last 10-Q. The reality revealed there is that the company has hardly any cash to carry out its business plan – that is to build a revolutionary live streaming pay-per-view social media network.

As the annual report states, XUII had raised $943 thousand in loans throughout 2012 and 2013. What remains of this loan as of the date of the last financial report, however, is only $7 thousand. What also catches the eye in the last quarterly report is the huge amount of money spent for General and Administrative purposes, which include corporate salaries – $407 thousand.

As the annual report states, XUII had raised $943 thousand in loans throughout 2012 and 2013. What remains of this loan as of the date of the last financial report, however, is only $7 thousand. What also catches the eye in the last quarterly report is the huge amount of money spent for General and Administrative purposes, which include corporate salaries – $407 thousand.

Then again XUII forecasts that it will need approximately $1.3 million to cover their expenses for the next 12 months. Curiously enough almost 40% of this sum, or $535 thousand, have been allocated for salaries.

It is far from clear how the company intends to satisfy the mentioned financial needs. As the financial report points out, XUII’s director is “unwilling to loan or advance any additional capital to the company.” At the same time XUII has not made any arrangements to raise additional capital, other than from the loans that have been received.

In the end the company admits that it will need to resort to equity or debt financing in order to meet its cash needs. Needless to say, the former doesn’t have a good ring to investors’ ears as it would eventually dilute the position of existing shareholders.

All things considered, the smoke-and-mirrors craft which has been mastered by penny stock promoters seems to be in full power with XUII stock. Those who know the game will have a good chance to cash in profits out of this story, unfortunately untrained investors will have to pay the price when the speculative bullish pressure on XUII gives way to the dumping of promoters and third parties.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.