After a brief bearish start of today’s trading session, the US stock markets are currently heading up, most likely due to the closing of short positions. Today’s beginning of the trading session was preceded by the report on the US Trade Balance which was estimated at $39.1 billion in July, which is $900 million higher than market expectations.

This produced an episodic fear at the beginning of the trading session but it was not long before the US stock markets recovered, so they are currently continuing the rally from yesterday.

The OTC Markets are following the example of the US benchmark indexes, so after a brisk decline at the opening bell, the OTCM ADR Index is currently up 0.49% at 1,421.98 points. Thus, most of today’s market movers on the OTC Markets are colored in green, which opens a plethora of speculative opportunities for common penny stock traders:

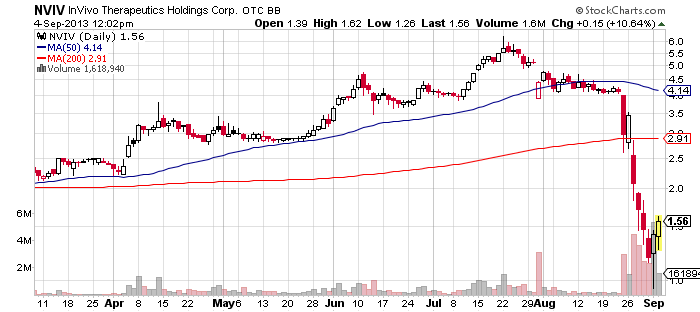

InVivo Therapeutics Holdings Corp (NVIV) – NVIV has been rebounding this week after the recent ominous nosedive, which instilled panic into the company’s shareholders. Yesterday, the same shareholders experienced another nerve-racking session after NVIV hit a new 52-week low and at the same time broke below the psychological $1 mark.

InVivo Therapeutics Holdings Corp (NVIV) – NVIV has been rebounding this week after the recent ominous nosedive, which instilled panic into the company’s shareholders. Yesterday, the same shareholders experienced another nerve-racking session after NVIV hit a new 52-week low and at the same time broke below the psychological $1 mark.

At the end of the trading day, however, NVIV, had recovered from the plunge and actually finished the trading session 18% higher at $1.41 per share on a higher than average volume of 5.3 million.

We have previously reported the continual series of Form-4s, showing the former CEO of NVIV selling part of his beneficial ownership in the company. The last couple of days, however, we have detected another bunch of Form-4s. This time they reported that NVIV’s CFO, Moran Sean F., have been loading company’s stock at a price around $1.3 per share.

We have previously reported the continual series of Form-4s, showing the former CEO of NVIV selling part of his beneficial ownership in the company. The last couple of days, however, we have detected another bunch of Form-4s. This time they reported that NVIV’s CFO, Moran Sean F., have been loading company’s stock at a price around $1.3 per share.

Happily for the company’s CFO, the current price of NVIV shares has jumped above his purchase price. If only this was valid for the common investors in NVIV, who held their shares during the dreadful decline of the stock in the last two weeks.

Currently shares of NVIV stock are trading 12% higher at $1.58 per share on a higher than average volume of 1.7 million.

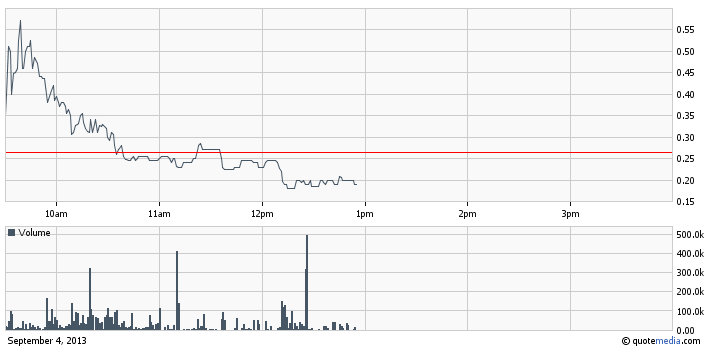

Press Ventures Inc (PVEN) – PVEN, a Poland based biosafety company with a website address at biosafetysystemsinc.com, is the next penny stock market mover on the OTC Markets today. This not-very-popular stock symbol has suddenly surged on today’s OTC top lists thanks to a market awareness campaign which was initiated two hours before the opening bell.

Press Ventures Inc (PVEN) – PVEN, a Poland based biosafety company with a website address at biosafetysystemsinc.com, is the next penny stock market mover on the OTC Markets today. This not-very-popular stock symbol has suddenly surged on today’s OTC top lists thanks to a market awareness campaign which was initiated two hours before the opening bell.

The campaign details are very scant, as the promoters of the company had disclosed neither their compensation, nor the third parties behind the campaign. At least we know the names of the promoting websites leading the campaign, viz. David Cohen, Penny Stock Scholar and Micro Cap Profiler.

The campaign details are very scant, as the promoters of the company had disclosed neither their compensation, nor the third parties behind the campaign. At least we know the names of the promoting websites leading the campaign, viz. David Cohen, Penny Stock Scholar and Micro Cap Profiler.

So, these three promoters’ newsletters have managed to attract so much attention to this stock that it has become the second most actively traded penny stock on the OTCQB exchange. So far, PVEN has generated a trade value of $1.6 million through 760 transactions.

Unfortunately, the promotion apparently hides a “conflict of interests” behind the meticulously hidden connections between the promoters and their sponsors because during the trading session PVEN was afflicted by a huge selling pressure which pushed the stock sharply down the chart.

In fact, PVEN opened the trading session in a good mood, that is to say way above the previous close. At the opening bell the stock gapped up at $0.345 and shortly shot up to an intraday high at $0.57 per share. This episode lasted only half an hour and, in fact, this was the only opportunity for market speculators to make profits from long positions in the stock, as PVEN subsequently plunged straight down below the previous close.

At the moment shares of PVEN stock are trading 25% lower at $0.20 per share on a higher than average volume of 7 million.

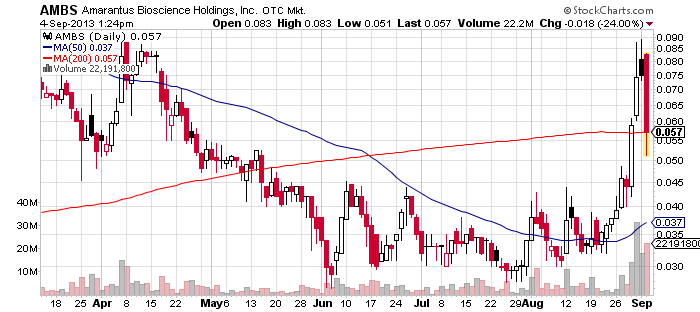

Amarantus Bioscience Holdings, Inc. (AMBS) – AMBS has stuck deep into a correction phase today. The current sharp decline followed the same sharp spike of the stock, which took place over the last two weeks.

During this period AMBS surged from $0.033 to yesterday’s intraday high at $0.090 per share. Today, however, it seems that penny stock traders are taking back profits from their long positions, which has driven the share price of AMBS stock down the charts.

During this period AMBS surged from $0.033 to yesterday’s intraday high at $0.090 per share. Today, however, it seems that penny stock traders are taking back profits from their long positions, which has driven the share price of AMBS stock down the charts.

Currently AMBS is trading 24% lower at $0.057 per share on a higher than average volume of 21 million.

The avalanche of sales orders could not be stopped by the press release which AMBS issued earlier today. In short, the company announced that it had entered into definitive agreements with institutional investors to raise $1.4 million in a private placement of convertible debentures and warrants led by Dominion Capital.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.