The major US stock markets got boosted today after a series of good economic data was released. First, the US GDP had grown by 2.5% in the second quarter of the year, while the market expected an increase of 2.1%. Second, the Initial Jobless Claims registered last week had decreased by 6000 to 331 thousand.

So far, these are signs that the US economy has been recuperating which, in fact, is a double-edged sword at this stage. On one hand, the good economic data can stimulate investors’ risk appetites, but on the other hand good economic data may raise concerns that the Fed would be more inclined to curtail is monetary stimulus program earlier than expected.

This is why the markets have been acting hesitantly these days. Thus, while the US benchmark indexes are going up at the moment, the OTC Markets keep falling dawn. Currently, the OTCM ADR Index is trading 0.30% lower at 1,404.30 points.

Despite the decline of the OTC Markets, there are numerous heavily traded penny stocks that are going up today, which will likely put them in the focus of market speculators:

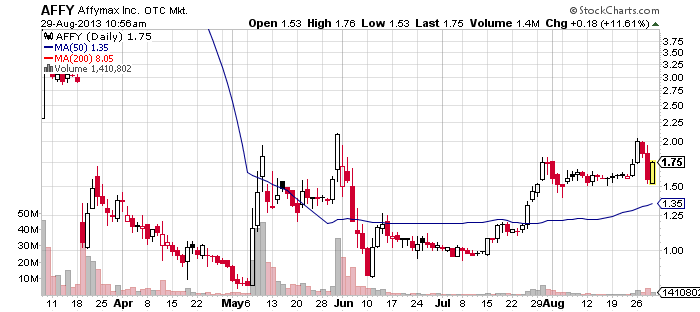

Affymax, Inc. (AFFY) – AFFY is the top traded penny stock today as investors have already exchanged a dollar volume of $1.7 million in a total of 500 trades with AFFY shares. Besides being intensively traded, AFFY is also experiencing a heavy buying pressure at the moment.

Affymax, Inc. (AFFY) – AFFY is the top traded penny stock today as investors have already exchanged a dollar volume of $1.7 million in a total of 500 trades with AFFY shares. Besides being intensively traded, AFFY is also experiencing a heavy buying pressure at the moment.

The upward move of the stock is happening on a technical basis, as AFFY has bounced up at its support level. Three days ago the stock broke above the resistance of its trading channel and hit $2.00 per share. However, AFFY was unable to maintain the higher ground, so it retracted back to its trading range in the last two trading sessions.

The upward move of the stock is happening on a technical basis, as AFFY has bounced up at its support level. Three days ago the stock broke above the resistance of its trading channel and hit $2.00 per share. However, AFFY was unable to maintain the higher ground, so it retracted back to its trading range in the last two trading sessions.

Yesterday, while the general mood on the OTC Markets was predominantly bearish, AFFY fell 15% to $1.56 per share on a higher than average volume of 3.9 million shares. Today, the stock opened below the previous close but immediately shot up and currently it is trading 12% higher at $1.75 per share on a lower than average volume of 1.1 million.

In other words, AFFY is once again positioned at the upper border of its former trading channel, and it looks like the stock is preparing for another test of the resistance.

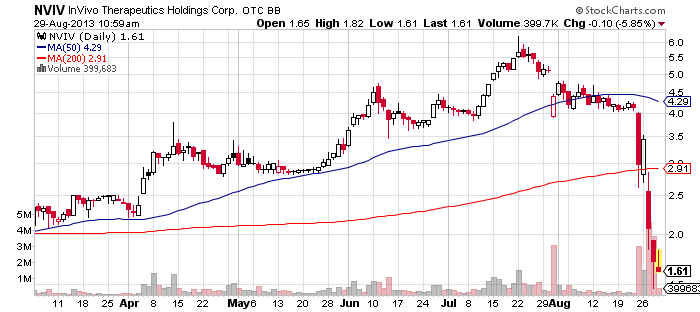

InVivo Therapeutics Holdings Corp (NVIV) – It looks like this has been a black week for NVIV stock as it keeps losing value at a hectic speed. This week NVIV crashed further down the charts, penetrating below the 200-MA.

InVivo Therapeutics Holdings Corp (NVIV) – It looks like this has been a black week for NVIV stock as it keeps losing value at a hectic speed. This week NVIV crashed further down the charts, penetrating below the 200-MA.

The last five trading sessions have been detrimental to NVIV stock value. During this time it fell from $4.00 to $1.61 per share, causing the value accumulated by NVIV over the last five months to disappear like sand through fingers.

The nightmare for NVIV shareholders continue today as the stock keeps heading down in tone with the declining OTCM ADR Index. Currently shares of NVIV stock are trading 6% lower at $1.61 per share on a lower than average volume of 400 thousand.

The nightmare for NVIV shareholders continue today as the stock keeps heading down in tone with the declining OTCM ADR Index. Currently shares of NVIV stock are trading 6% lower at $1.61 per share on a lower than average volume of 400 thousand.

NVIV has been afflicted by an avalanche of sales orders since the resignation of the company’s CEO and Director, Franc Reynolds, was officially announced. The fall of NVIV value could not be stopped by the press release issued two days ago, announcing an update on the clinical timeline for NVIV’s biopolymer scaffolding to treat acute spinal cord injuries.

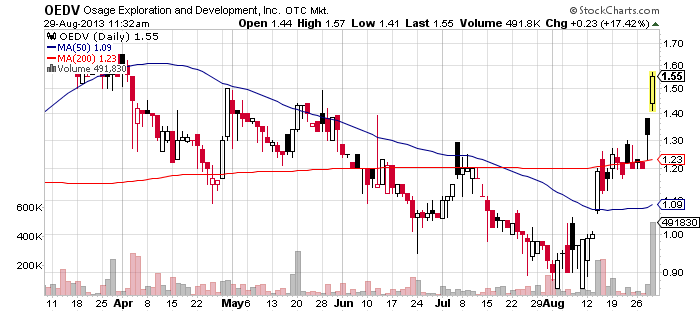

Osage Exploration and Development, Inc. (OEDV) – OEDV is another heavily traded penny stock on the OTC Markets today. What is notable about OEDV is that the value of its shares increased sharply in the last two weeks.

Osage Exploration and Development, Inc. (OEDV) – OEDV is another heavily traded penny stock on the OTC Markets today. What is notable about OEDV is that the value of its shares increased sharply in the last two weeks.

On the first place, OEDV stock was boosted in mid-August when the company reported its financial results for the second quarter 2013. According to the press release, OEDV had registered a 75.8% increase in revenues of $2.4 million compared with the same period a year ago, and an operating income of $1.2 million versus a loss of $275 thousand for the same period a year ago.

On the day of the report, OEDV stock jumped up 19% to $1.19 per share on a higher than average volume of 235 thousand. This week, OEDV was additionally boosted by the Syrian problem, which is expected to substantially inflate the price of oil.

On the day of the report, OEDV stock jumped up 19% to $1.19 per share on a higher than average volume of 235 thousand. This week, OEDV was additionally boosted by the Syrian problem, which is expected to substantially inflate the price of oil.

Thus, as of the last closing bell the price of OEDV shares had increase to $1.32. Today, OEDV keeps the up-move, as currently shares of OEDV stock are trading 17% higher at $1.55 per share on a ten times higher than average volume of 475 thousand.

Last week, the company released the preliminary production results on the Mallard 1-16 Horizontal Mississippian well in Oklahoma, which were estimated at 705 barrels of oil per day.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.