Top Promoted Penny Stocks: NUVI, SEEK, GNCP

Yesterday, weak fundamental data suppressed the market which resulted in a decline of Dow Jones while investors sought safety in the stocks of big technology companies.

The OTC Markets also provided safe haven from the struggling blue chips market as the OTCM ADR index posted an increase of 0.16% at 1,424.46. Today, a series of important fundamental news, such as Q2 GDP revision, crude oil inventories and Fed’s decision about the monetary policy, are expected to be publicized which will decide the fate of the US benchmark indexes.

Apart from the key economic statistics which are coming out today, the OTC Markets are also influenced by the general promotional activities which are typical for the penny stock realm. This is why we are going to examine the most important market awareness campaigns that are going to exert their influence on the forthcoming session:

Emo Capital Corp. (NUVI) – One week after the last campaign on NUVI, the stock is once again crowning the headlines of a multitude of paid newsletters. The campaign on NUVI was initiated yesterday after the closing bell and according to disclaimers the promotion had been backed up by Cambridge Consulting Group.

Emo Capital Corp. (NUVI) – One week after the last campaign on NUVI, the stock is once again crowning the headlines of a multitude of paid newsletters. The campaign on NUVI was initiated yesterday after the closing bell and according to disclaimers the promotion had been backed up by Cambridge Consulting Group.

Online databases also show that a total of $32,500 had been invested in the advertising effort on NUVI. Perhaps, penny stock traders remember that NUVI was promoted last week on July 23. On that day, the stock surged 2% to $0.09 after hitting an intraday high at $0.115 per share on a ten times higher than average volume of 2.3 million.

NUVI kept attracting huge trading activity but unfortunately sale outs prevailed, so the stock value had diminished significantly by the end of the week. NVUI went through another bearish session yesterday after it lost 16% of its stock value and closed the session at $0.057 per share on a below average volume of 114 million.

NUVI kept attracting huge trading activity but unfortunately sale outs prevailed, so the stock value had diminished significantly by the end of the week. NVUI went through another bearish session yesterday after it lost 16% of its stock value and closed the session at $0.057 per share on a below average volume of 114 million.

The most recent movement of NUVI stock has been happening without any fundamental support as no press releases or filings have been issued by the company since the beginning of last week’s promotion.

Meanwhile the company’s market cap has dwindled to $1.9 million but there is still more room for devaluation, especially if the new promotion of NUVI turns out as detrimental as the previous one.

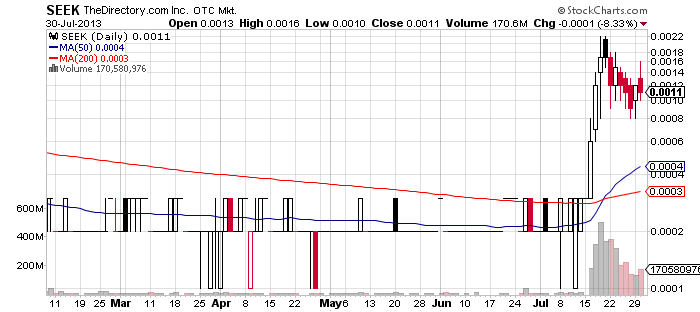

TheDirectory.com, Inc. (SEEK) – SEEK has received a second promotional backup this week, despite the fiasco of yesterday’s campaign. SEEK had the highest paid promotion yesterday but apart from attracting more trading interest than usual, the campaign didn’t manage to sustain an increase in SEEK share value.

TheDirectory.com, Inc. (SEEK) – SEEK has received a second promotional backup this week, despite the fiasco of yesterday’s campaign. SEEK had the highest paid promotion yesterday but apart from attracting more trading interest than usual, the campaign didn’t manage to sustain an increase in SEEK share value.

In fact the stock traded above the previous close for only about half an hour after the openening bell reaching an intraday high at $0.0016. However, common traders were not able to make any profits from this movement as SEEK opened with a gap up at $0.0013. Eventually, SEEK closed the trading session 8% lower at $0.0011 on a higher than average volume of 170 million.

Apart from the promotion, SEEK stock has also received a fundamental back up today after the company announced that it had agreed on a strategic partnership with City Grid Media for local search content.

Apart from the promotion, SEEK stock has also received a fundamental back up today after the company announced that it had agreed on a strategic partnership with City Grid Media for local search content.

Nevertheless, SEEK still remains a risky invest because, as we wrote yesterday:

- It was a triple zeros penny stock until recently

- It is a limited information pink sheets company

- It is an object of speculative stock promotions

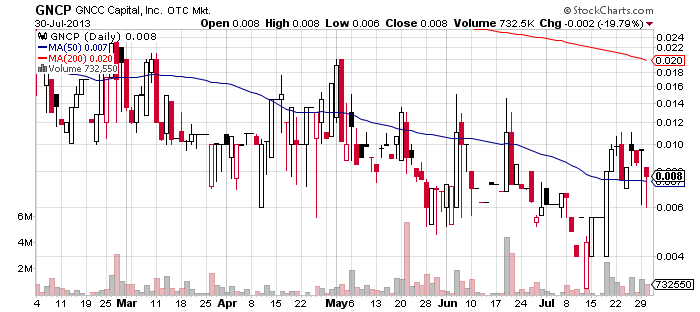

GNCC Capital, Inc. (GNCP) – Today, GNCP is preparing for a new promotional round after last week’s massive campaign. The previous promotion of GNCP took place last Thursday when the stock experienced a volume explosion and also surged up 15% in value at $0.0095.

GNCC Capital, Inc. (GNCP) – Today, GNCP is preparing for a new promotional round after last week’s massive campaign. The previous promotion of GNCP took place last Thursday when the stock experienced a volume explosion and also surged up 15% in value at $0.0095.

The next couple of days, however, the share price declined down to $0.007 and it is at this base where GNCP will start the trading session today. Additionally the stock will trade with both promotional and fundamental support.

Today’s market awareness campaign on GNCP is led by Penny Stock Mobsters and Wall Street Surfers who had been compensated $9,000 by a third party called Quality Stocks LLC.

Today’s market awareness campaign on GNCP is led by Penny Stock Mobsters and Wall Street Surfers who had been compensated $9,000 by a third party called Quality Stocks LLC.

Earlier today, the company also announced that it was focusing on three gold mining properties, Clara, Burnt Well and White Hills as these were characterized as both “low cost” and “potentially economically viable.”

GNCP is an exploration company focusing in its three gold and three silver exploration projects located in Arizona, USA. The company is publicly traded on the Pink Sheets Markets with a current information status. GNCP currently has a market cap of $2.3 million and a 52-week trading range of 0.09 – 0.0031.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.