Top Promoted Stocks: RAFA, OOIL, CPLI

Last Friday there was a balance between bullish and bearish forces on the OTC markets as the OTCM ADR Index registered only a small down-move of 0.03% at 1,356.38. There was also an ostensibly lower interference by promoters on the last trading session, but today the picture is different. Over the weekend our radars have detected a dozen new promoted penny stocks, so we decided to provide an overview of the biggest promotions that are going to hit the forthcoming session:

Rafarma Pharmaceuticals, Inc. (RAFA) – The highest paid promotion today is dedicated to RAFA. The campaign is led by Quality Stocks, an affiliate of Dream Team Group, which expects to receive $5,500 from RAFA for 180 days of advertising, branding, marketing, investor relations, social media services and video production.

Rafarma Pharmaceuticals, Inc. (RAFA) – The highest paid promotion today is dedicated to RAFA. The campaign is led by Quality Stocks, an affiliate of Dream Team Group, which expects to receive $5,500 from RAFA for 180 days of advertising, branding, marketing, investor relations, social media services and video production.

The campaign was started last night when the promoter issued a newsletter with a short trade alert dedicated to RAFA without an extensive coverage of the company.

RAFA is a Russia based multi-product pharmaceutical company which has acquired the ownership of the distributed pre-tax revenue of ZAO Rafarma, a manufacturer of generic pharmaceuticals and proprietary medications.

The last unofficial and unaudited financial report of RAFA shows that as of May 31,2013 the company had:

- Zero cash

- Zero revenue

- $2.4 million accumulated deficit

In the same financial report RAFA states it expects to receive “significant revenue from its investment in ZAO Rafarma.”

Three weeks ago the company announced it had commenced production of the antibiotic Ceftriaxone, which treated inflammatory infections of the abdominal cavity. RAFA also said it had entered into a long term distribution agreement with the Russian national retail chain OAO A5 Pharmacy Ltd.

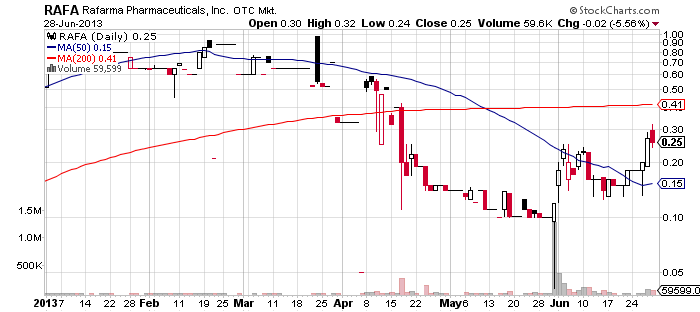

The trading activity around RAFA stock shot up sharply at the end of May this year without any obvious reason. Since then the value of RAFA stock has increased three times. On Thursday last week, RAFA soared 35% on a higher than average volume, then on Friday it dropped down 5% and the stock finished the week at $0.255 per share.

RAFA is traded on the OTC Pink Current Information Market where it is valued at $20.7 million. According to OTC Markets, the company holds 81 million shares issued and outstanding of which 1.6 million comprise the public float. Within the last twelve months RAFA stock has established a 52-week range of 1.60 – 0.041.

OriginOil, Inc. (OOIL) – OOIL is another stock symbol that has been crowning the newsletters of several stock promoters since yesterday. The campaign on OOIL is led by Premiere Alerts, OTC Magic and MBSA, who had received a total of $21,000 for the market awareness service, according to online promotional databases.

OriginOil, Inc. (OOIL) – OOIL is another stock symbol that has been crowning the newsletters of several stock promoters since yesterday. The campaign on OOIL is led by Premiere Alerts, OTC Magic and MBSA, who had received a total of $21,000 for the market awareness service, according to online promotional databases.

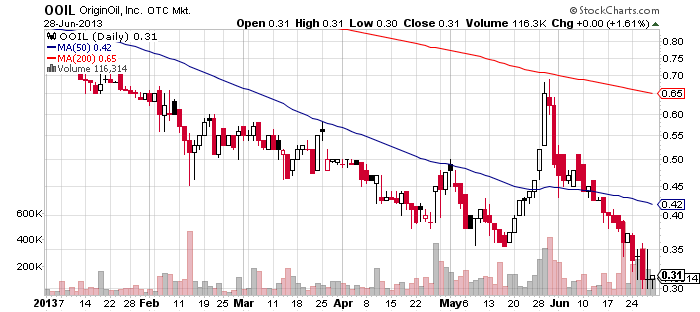

OOIL has not been promoted since February this year, so the stock can be considered free of any recent artificial influences. However, OOIL has formed a strong downtrend over the last 12 months and has just hit a new 52-week low at $0.30 per share.

The current financial state of the company boils down to the following key parameters as of Mar 31, 2013:

- $2.9 million working capital deficit and $30.2 million accumulated deficit

- Zero revenues for the first quarter 2013

- $2.6 million net loss for the first quarter 2013

Last Thursday the company announced New Global Energy (OTCQB:NGEY) would adopt OOIL’s water sanitizing and algae production technology as part of its strategy to acquire and restart shuttered fish farms in Southern California.

However the announcement didn’t produce any significant effect on the stock as the same day it surged only 1.5% on a volume two times higher than the monthly average.

OOIL is a company which helps algae growers extract oil from algae for commercial fuels, chemicals and foods by means of a technology which dewaters and breaks down algae for its useful products. OOIL is traded on the OTCQB Market where it is currently valued at $8.4 million. The company also has a 52-week range of 1.28 – 0.30.

Calpian, Inc. (CLPI) – CLPI is another client of Dream Team Group, besides RAFA, which we already mentioned above. Online promotional databases reveal that CLPI had ordered 90 days of advertising, branding, marketing, investor relations and social media services from MIR, and affiliate of Dream Team Group, for the amount of $25,000.

Calpian, Inc. (CLPI) – CLPI is another client of Dream Team Group, besides RAFA, which we already mentioned above. Online promotional databases reveal that CLPI had ordered 90 days of advertising, branding, marketing, investor relations and social media services from MIR, and affiliate of Dream Team Group, for the amount of $25,000.

CLPI is a very irregularly traded stock whose trading activity dropped significantly last week as it couldn’t generate a trading volume of more than 6 thousand. Thusa, on the last trading session CPLI generated a trading volume of only 2 thousand while its stock price remained unchanged at $1.90 per share.

For the last financial quarter ended March 31, 2013, CLPI reported:

For the last financial quarter ended March 31, 2013, CLPI reported:

- $380 thousand cash

- $470 thousand working capital surplus and $9.1 million accumulated deficit

- $1,6 million in revenues and $1 million in net loss

The company has not issued any announcements recently which explains to a large extent the lack of trading interest towards the stock, a fact which may change after the forthcoming promotion.

CPLI is a mobile payments company with corporate offices in Dallas, Texas which is traded on the OTCQB Markets. The company currently has a market cap of $48,6 million and a 52-week range of 2.75 – 1.01.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.