Top Promoted Stocks: NTEK, PSID, PGVI

Yesterday, investors were relieved by Bernanke’s words before the US Congress, but today market players will also be alert as Fed’s Chairman is going to account for his activities before the lawmakers. After being relived by Bernanke’s declaration that the Fed will keep a flexible stance towards the monetary easing policy, the major US stock indexes registered a modest increase.

The same was the situation on the OTC markets, where the OTCM ADR index climbed up 0.37% to 1,419.54. Yesterday, penny stock traders could witness a decent number of stock promotions which kept influencing the first half of the trading session on the OTC Markets. The forthcoming session will also face the same setup as online databases show that penny stock promoters have been as active as usual and they have issued several promotions which are worth noticing by those who are interested in the microcap segment:

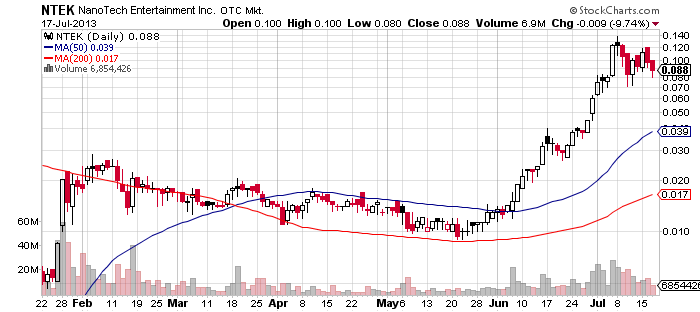

NanoTech Entertainment, Inc. (NTEK) – NTEK has received its third promotion in a row for the week as several stock promoters, among which 007 Stock Chat, Penny Stock Spy, Stock Market Media Group and Penny Dreamers, have been spreading newsletters dedicated to the company.

NanoTech Entertainment, Inc. (NTEK) – NTEK has received its third promotion in a row for the week as several stock promoters, among which 007 Stock Chat, Penny Stock Spy, Stock Market Media Group and Penny Dreamers, have been spreading newsletters dedicated to the company.

The total amount of money invested in today’s promotional wave sums up to $28,000 but there is no information about the third parties who have provided the money. On the whole, NTEK was promoted on Tuesday and Wednesday this week, but the stock didn’t have a chance to make long investors happy as it fell 13% and 10% respectively. On the last trading session NTEK closed at $0.088 per share on a volume of 6.8 million.

The dumping phase of the promotion turned out so strong that it suffocated the effect of the two press releases which the company issued during the previous two days. On Tuesday, NTEK announced that it had selected the NVIDIA Tegra 4 mobile processor as the basis for its new 4K Ultra HD players. Despite the announcement, the stock lost a significant part of its value on a higher than average volume of 12.5 million.

The dumping phase of the promotion turned out so strong that it suffocated the effect of the two press releases which the company issued during the previous two days. On Tuesday, NTEK announced that it had selected the NVIDIA Tegra 4 mobile processor as the basis for its new 4K Ultra HD players. Despite the announcement, the stock lost a significant part of its value on a higher than average volume of 12.5 million.

Yesterday, the company announced it had completed the acquisition of Clear Memories Inc., a provider of 3D Ice Sculptures to the San Francisco Bay Area. Today, there hasn’t been any new press releases issued by the company and yet the promotional campaign continues despite the disappointing performance of the stock in the previous sessions.

Two weeks ago NTEK hit an 52-week high and since then it has been consolidating around this level but it seems that there is not enough demand for the stock to push it higher, especially now that the company has reached a market cap of $48 million.

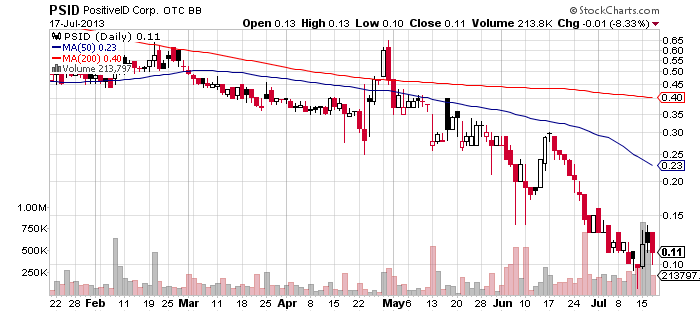

PositiveID Corp. (PSID) – Today, PSID has received a promotional coverage that has involved more than 10 promoting websites, such as Psycho Penny Stocks, Marquee Penny Stocks, Liquid Pennies, Stock Hunter, VIP Stock Alerts, Hero Stocks and so on.

PositiveID Corp. (PSID) – Today, PSID has received a promotional coverage that has involved more than 10 promoting websites, such as Psycho Penny Stocks, Marquee Penny Stocks, Liquid Pennies, Stock Hunter, VIP Stock Alerts, Hero Stocks and so on.

According to online databases, the campaign had cost $20,000, part of which was provided by Hanover Financial Services, while the other part was provided by an undisclosed third party.

PSID has been a regular object of stock promotions in the last couple of weeks. However, this didn’t prevent the stock from hitting a 52-week low at $0.082 last week. In fact the stock has declined sharply since mid-June falling down from $0.30 per share to a 1-year low over the course of several weeks.

PSID has been a regular object of stock promotions in the last couple of weeks. However, this didn’t prevent the stock from hitting a 52-week low at $0.082 last week. In fact the stock has declined sharply since mid-June falling down from $0.30 per share to a 1-year low over the course of several weeks.

Today, PSID issued a press release to announce that its chairman and CEO, William Caragol, would present at the Financial Service Exchange (FSX) Investment Conference in Fort Lauderdale, FL on July 26th. This news is not very likely to influence the stock enough to overcome the selling pressure which has gripped SPID stock since the last trading session, when SPID declined 8% to $0.11 per share on a higher than average volume of 213 thousand.

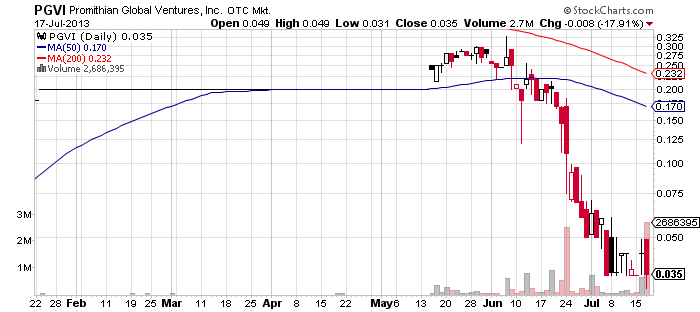

![]() Promithian Global Ventures, Inc. (PGVI) – PGVI is once again in the promotional lists today with a campaign supported by Microcap Innovations, which has provided a compensation $9,000 to a group of six promoting websites.

Promithian Global Ventures, Inc. (PGVI) – PGVI is once again in the promotional lists today with a campaign supported by Microcap Innovations, which has provided a compensation $9,000 to a group of six promoting websites.

PGVI has turned into a nightmare for long investors after it plummeted dramatically over the last couple of weeks. While at the end of May PGVI traded at $0.30 per share, it fell down sharply in June and in the beginning of this month it hit a bottom at $0.035 per share.

Yesterday the stock fell down 18% to $0.035 per share on a ten times higher than average volume of 2.7 million. Thus the company’s current market cap diminished to $4.5 million.

Yesterday the stock fell down 18% to $0.035 per share on a ten times higher than average volume of 2.7 million. Thus the company’s current market cap diminished to $4.5 million.

Yesterday PGVI announced it was leading negotiations to form an option agreement for a copper-zinc-silver-gold property in Northern Canada. Despite the announcement, PGVI lost a considerable part of its stock value, so it seems that at present PGVI stock is experiencing selling pressure that is most likely produced by the regular promotions of the company.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.