Top Promoted Penny Stocks: ADBI, NDEV

Last Friday, while most of the US benchmark indexes were going up, the OTCM ADR index was grappling with a heavy selling pressure which took away 0.57% of the index value and brought it down to 1,430.52.

On Friday it became apparent that investors on the major US stock exchanges were acting tentatively while the markets were consolidating at their all-time highs, whereas penny stock traders were disheartened when the session opened with one of the major market movers on the OTC Markets, Xumanii (XUII), being marked with a caveat emptor sign which caused an avalanche of selling orders on the stock.

Nevertheless, as the OTC Markets are about to hail the new trading week it will not be surprising if we see new penny stock stars surging to replace the old favorites of the OTC Markets. Over the week we have detected a lot of promotional activities, so let’s see what the major campaigns for today are:

ADB International Group, Inc. (ADBI) – Today we have a brand new promotion in the face of ADB International Group, Inc. This is the first time the company gets promoted which will likely make it an interesting object of speculations on the penny stock market today.

ADB International Group, Inc. (ADBI) – Today we have a brand new promotion in the face of ADB International Group, Inc. This is the first time the company gets promoted which will likely make it an interesting object of speculations on the penny stock market today.

There are four promoters, whose newsletters have been touting ADBI since yesterday afternoon. Their names are Penny Stock Players, Penny Stock Pros, The Stock Scout, and Stock Market Quote. They have been compensated $60,000 by a third party called L & L Holding Ltd. It is interesting to note that this is the first time this third party has shown up in online promotional databases.

Earlier today ADBI issued a press release via PR Newswire saying that Treatec21, which is ADBI’s licensor, had signed an agreement with Shunde Dowell Technological and Environmental Engineering Co. Ltd. to implement Treatec21’s proprietary wastewater purification technology for a large commercial wastewater purification project in China.

What grabs the eye about ADBI on its stock chart is the fact that it doesn’t seem to regularly generate any significant trading activity. Having hit a 52-week high at $0.095 per share on Thursday, the stock plummeted at the end of the trading session losing 22% of its value. On the next day shares of ADBI recovered a little bit, closing 14 % up at $0.08 per share.

What grabs the eye about ADBI on its stock chart is the fact that it doesn’t seem to regularly generate any significant trading activity. Having hit a 52-week high at $0.095 per share on Thursday, the stock plummeted at the end of the trading session losing 22% of its value. On the next day shares of ADBI recovered a little bit, closing 14 % up at $0.08 per share.

The low trading activity around ADBI stock can be explained with the typical financial anemia demonstrated by the majority of penny stock companies. ADBI has not been able to generate any revenue since reentering development stage in 2010. For the last fiscal quarter ended March 2013, the company had reported a very weak cash position of only $2,700, a working capital deficit of $124 thousand and an accumulated deficit of $1.2 million. The company also reported a net loss of $30 thousand for the same quarter.

ADBI has a market cap of $6.1 million and a 52-week range of 0.095 – 0.0012. If the current promotion dedicated to ADBI manages to create some interest to the stock, it may enjoy some episodes of green trading but it seems that investors will need much more proofs that the company is giving its best to make its way to profitability in order to grant ADBI their support for the long term.

Novus Acquisition & Development Corp. (NDEV) – Today, the promotion of NDEV is the one with the highest number of promoters involved. Online promotional databases show that more than fifteen promoting entities have joined the campaign on NDEV.

Novus Acquisition & Development Corp. (NDEV) – Today, the promotion of NDEV is the one with the highest number of promoters involved. Online promotional databases show that more than fifteen promoting entities have joined the campaign on NDEV.

Scrolling through the campaign’s details we can see that the third parties which are backing up the advertising effort of NDEV are the Stock Mister, Micro-Cap Consultants, and M and M Asset Management Group. Again according to online databases, the cumulative compensation for the current promotion of NDEV sums up to $50,000.

The last time NDEV was promoted was on June 20, 2013, but the effect of the campaign was negligible as during that day only 180 thousand shares of NDEV common stock changed hands which is below the monthly average while the share price dropped down 2%.

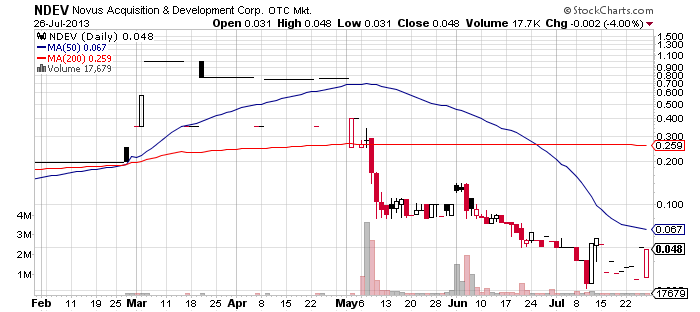

On Friday, shares of NDEV closed at $0.048, down 4%, on a volume of only 17 thousand shares. This reduced the company’s market cap to $7.8 million. At the same time, NDEV stock has been trapped in a downtrend since it exploded in trading in May this year, sliding down from $0.4 per share to the last close of $0.048 per share. During all this time the stock has been trading below the 50 and 200-MAs.

On Friday, shares of NDEV closed at $0.048, down 4%, on a volume of only 17 thousand shares. This reduced the company’s market cap to $7.8 million. At the same time, NDEV stock has been trapped in a downtrend since it exploded in trading in May this year, sliding down from $0.4 per share to the last close of $0.048 per share. During all this time the stock has been trading below the 50 and 200-MAs.

However, penny stock traders should not foster illusions that NDEV has hit a bottom as the company still has a room to devaluate especially given that it has not provided a healthy financial base to support its stock value as shown in the last couple of unofficial quarterly reports filed by the company.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.