Top Promoted Penny Stocks: FEEC, PTOG, FBCD

Yesterday, the major US stock indexes hit new all-time highs after a series of positive economic data incited investors’ risk appetite. The highest increase was registered by NASDAQ which climbed 1.36%, then on the second place came the OTCM ADR Index which finished 1.30% higher at 1,442.89.

Apparently emotions took their toll on penny stock investors after yesterday’s intensive session, so today the OTC Markets seem inclined to take respite as there have been very few news releases and insignificant promotional activities since the last closing bell.

Adding the fact that today is Friday, which is typically marked by a lesser trading activity, it can be expected that today the trading session on the OTC Markets will unfold on a much lighter pace. Yet, penny stock promoters have not been entirely idle since the end of the last trading session, so we can still look at the few promotions that are going to hit the market today:

Far East Energy Corp. (FEEC) – FEEC is one of penny stock promoters’ targets for Friday. The company’s name crowned the headline of a stock alert which was issued by Information Solutions Group LLC. The latter disclosed that he had been compensated $7,500 by FEEC to market the company and denied owning any shares of FESC stock.

Far East Energy Corp. (FEEC) – FEEC is one of penny stock promoters’ targets for Friday. The company’s name crowned the headline of a stock alert which was issued by Information Solutions Group LLC. The latter disclosed that he had been compensated $7,500 by FEEC to market the company and denied owning any shares of FESC stock.

This is the first time the company gets promoted, which makes it more likely for the camping to bring more trading volume towards FEEC stock. However, Information Solutions Group’s profile on the major online promotional databases shows that this promoter has not been able to present any opportunities for gains through its last couple of picks, all of which had ended in red after the promotion.

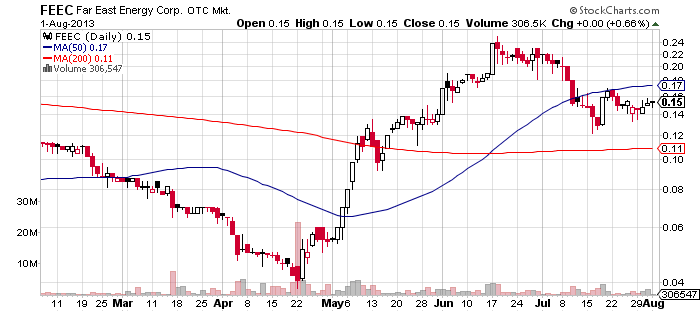

Between May and June this year, FEEC stock registered a remarkable gain rising from $0.04 to $0.24 over the same period. However, FEEC stock entered into correction in July and three weeks ago it also fell below the 50-MA.

Between May and June this year, FEEC stock registered a remarkable gain rising from $0.04 to $0.24 over the same period. However, FEEC stock entered into correction in July and three weeks ago it also fell below the 50-MA.

On the last trading session, FEEC closed 1% higher at $0.153 per share on a lower than average volume of 300 thousand. The stock has been slowly losing ground in the last couple of days as it has not received any fundamental support since July 18 when it was announced that 9 new wells had commenced drilling.

On the same day FEEC jumped up 23% to $0.159 per share on a higher than average volume of 3.2 per share. The stock has been consolidating around this level since the announcement.

FEEC is a company which explores and develops methane projects in China. It is publicly traded on the OTCQB Market where it has a market capitalization of $53 million and a 52-week range of 0.25 – 0.038.

Petrotech Oil & Gas, Inc. (PTOG) – Penny stock promoters have also been touting PTOG since the last closing bell. The campaign is led by an undisclosed third party which had provided $5,500 for the advertising effort on PTOG.

Petrotech Oil & Gas, Inc. (PTOG) – Penny stock promoters have also been touting PTOG since the last closing bell. The campaign is led by an undisclosed third party which had provided $5,500 for the advertising effort on PTOG.

Apart from the promotion, the company has also tried to add to the intrigue around PTOG stock by issuing a press release through PR Newswire, which announced that PTOG had hit oil on well number 11 in Navarro County Texas.

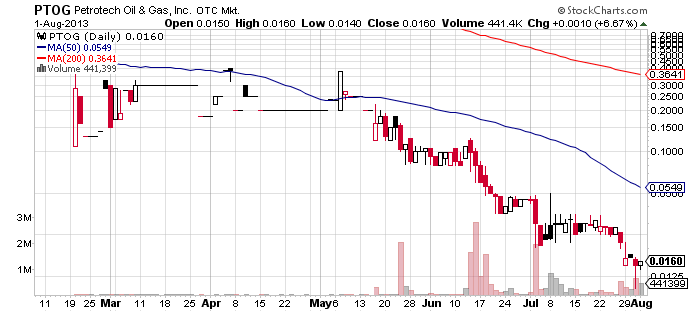

Over the last couple of months, PTOG stock value has plummeted from $0.4 to $0.016 per share leaving the company with a modest market cap of $570 thousand. Last week, PTOG generated higher than the usual trading activity. On the last trading session, PTOG stock went 7% to $0.016 per share on a higher than average volume of 441 thousand.

Over the last couple of months, PTOG stock value has plummeted from $0.4 to $0.016 per share leaving the company with a modest market cap of $570 thousand. Last week, PTOG generated higher than the usual trading activity. On the last trading session, PTOG stock went 7% to $0.016 per share on a higher than average volume of 441 thousand.

Overall, through its historic performance PTOG stock has proven to be carrying a much higher risk than usual even at such low market valuation. Therefore, investors will have to assess carefully their strategy if they plan to speculate with this pink sheet stock.

FBC Holding, Inc. (FBCD) – FBCD cannot boast with an expensive market awareness campaign today as online databases show that third parties have invested only $2,000 for the current advertising effort on the stock.

FBC Holding, Inc. (FBCD) – FBCD cannot boast with an expensive market awareness campaign today as online databases show that third parties have invested only $2,000 for the current advertising effort on the stock.

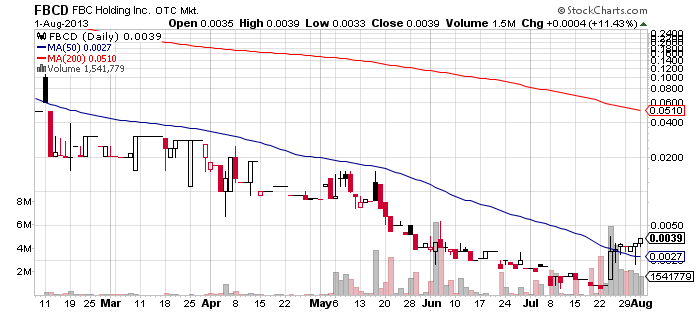

FBCD has demonstrated a momentum for the last two weeks rising from $0.0015 to $0.0039 on a heavy trading volume. Yesterday, FBCD climbed 11% to $0.0039 per share on a higher than average volume of 1.5 million.

The exaltation of FBCD stock has been provoked by a series of press releases published in the previous two months. Today, the company issued a new press release announcing its interactive marketing strategy for 2013 – 2014.

The exaltation of FBCD stock has been provoked by a series of press releases published in the previous two months. Today, the company issued a new press release announcing its interactive marketing strategy for 2013 – 2014.

As we already mentioned, today FBCD is also going to receive promotional support. The company has not been promoted since May this year so the current campaign has a higher chance to attract more trading activity towards FBCD stock.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.