Top Promoted Penny Stocks: REVI, UOMO, NUVI

Yesterday, US stock markets were mostly positive as investors still feel relieved after last week’s assertion that the Fed do not plan to alter the monetary easing policy at this stage. In addition, the US benchmark indexes kept climbing throughout the last trading session, despite the reported 1.2% decrease in real estate sales in June.

The session on the OTC Markets was also positive as the OTCM ADR Index jumped 0.23% to 1,429.43. Yesterday, most of the market movers on the OTC market were in a bullish mode, keeping penny stock players excited throughout the whole trading session. This excitement will most likely transfer to today’s session as well, so it will be a good point to make a review of the major OTC Markets events before the opening bell, starting with the biggest penny stock promotions:

![]() Resource Ventures Inc. (REVI) – On the first place, we have a Pink Sheets company which has crowned the titles of more or less ten paid newsletters since the last closing bell. So far, this is the highest paid new promotional campaign for today, with a total compensation reaching $45,000.

Resource Ventures Inc. (REVI) – On the first place, we have a Pink Sheets company which has crowned the titles of more or less ten paid newsletters since the last closing bell. So far, this is the highest paid new promotional campaign for today, with a total compensation reaching $45,000.

The campaign is backed up by several third parties among which The Stock Mister, RTF Inc., and M and M Asset Management Group. The promotion has been channeled through various market awareness websites, such as Psycho Penny Stocks, Marquee Penny Stocks, Penny Stock Money Train, Winning Penny Stock Alerts and many others.

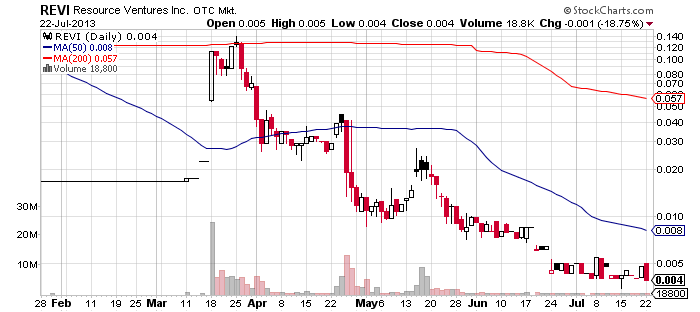

Most of the promoters are presenting REVI as a bottom play and indeed the chart shows that the stock has been consolidating for some while after a deep plunge that took place in the spring of 2013. Indeed, this is a good technical setup for REVI but a bounce up at the bottom is never certain in the case with pink sheets, especially when there are so many promoters and third parties involved in the market awareness campaign of REVI.

Most of the promoters are presenting REVI as a bottom play and indeed the chart shows that the stock has been consolidating for some while after a deep plunge that took place in the spring of 2013. Indeed, this is a good technical setup for REVI but a bounce up at the bottom is never certain in the case with pink sheets, especially when there are so many promoters and third parties involved in the market awareness campaign of REVI.

According to the last unofficial report of REVI, the company had issued 472,660,547 shares of common stock with 92,660,437 outstanding as of March 31, 2013. This means that the current market capitalization of REVI is $1.8 million, or in other words there is still room for the company to devaluate if it gets afflicted by a strong selling pressure.

Today, a press release came out of the company which announced that REVI had divested itself from its unprofitable wholly owned subsidiary Global Energy Management Ltd. However, investors are yet to see how this restructuring will affect the company’s financial reports.

Speaking of financials, it is curious to note that the last unofficial quarterly report showed that the company had as of March 31, 2013:

- $652,000 in assets

- $321,000 in liabilities

- $356,000 in revenues

- $15,378 net income

However, the financial report, which is not that bad for a penny stock company, was not enough to support REVI’s stock value, which has fallen 97% since March.

REVI is a global electrical power production and petroleum Exploration Company which is focused on the acquisition and development of power generation and energy production projects. The company is publicly traded on the OTC Pink Current Information market where it holds a 52-week range of 1.78 – 0.0035.

UOMO Media, Inc. (UOMO) – UOMO is the object of the next big promotion for today. The third parties which stand behind this campaign are ODD Marketing LLC and Patan Admin Ltd. They have provided a compensation totaling $42,750 for a one-day advertisement.

UOMO Media, Inc. (UOMO) – UOMO is the object of the next big promotion for today. The third parties which stand behind this campaign are ODD Marketing LLC and Patan Admin Ltd. They have provided a compensation totaling $42,750 for a one-day advertisement.

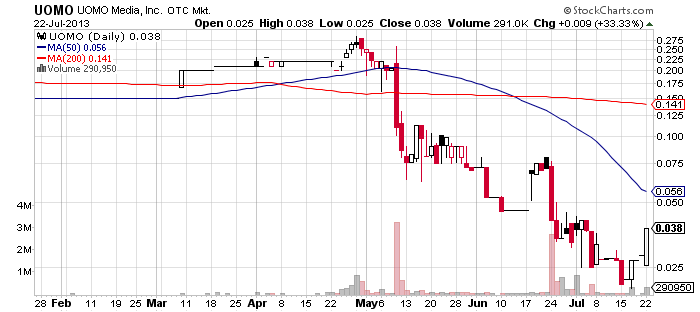

The campaign is being distributed by several penny stock promoting websites, such as Penny Stocks Profile, Nathan Gold, Breakout Stocks, Penny Stocks 101, Penny Stock Crew and so on. There has been almost a month since the last promotion of the company and during this period UOMO’s stock value has plummeted significantly.

On the very date of the last promotion of the company, which was June 24, the share price of UOMO stock fell 42% to $0.041 on a heavy trading volume. UOMO kept devaluating in the next couple of weeks as well, hitting a 52-week low at $0.021, but in the last trading session the stock price rose unexpectedly by 33% to $0.038 per share on a higher than average volume of 290 thousand.

On the very date of the last promotion of the company, which was June 24, the share price of UOMO stock fell 42% to $0.041 on a heavy trading volume. UOMO kept devaluating in the next couple of weeks as well, hitting a 52-week low at $0.021, but in the last trading session the stock price rose unexpectedly by 33% to $0.038 per share on a higher than average volume of 290 thousand.

This move happened without any recent press releases or reports being filed, so the rise of UOMO stock seems very suspicious, especially given that it happened just before the stock promotion.

UOMO is an entertainment company traded on the OTC Pink Current Information Market which acquires, produces and manages intellectual media content and digital assets. The company has a market cap of $4.4 million and a 52-week range of 0.289 – 0.02.

Emo Capital Corp. (NUVI) – Another campaign that looms on the horizon today is dedicated to NUVI. The promotion is backed up by a third party called Legacy Global Markets which had invested $35,000 for the advertising service.

Emo Capital Corp. (NUVI) – Another campaign that looms on the horizon today is dedicated to NUVI. The promotion is backed up by a third party called Legacy Global Markets which had invested $35,000 for the advertising service.

Regular market players might remember that NUVI was previously promoted on Jun 27, which ended with a 24% decrease in the share price on a heavy trading volume.

Since then, NUVI has been moving sideways on the chart except for yesterday when the stock jumped 10% to $0.088 per share on a higher than average volume of 400 thousand. This happened after the company announced that it had acquired the customer base of ME-4Free, a US based online natural male enhancement products community.

Since then, NUVI has been moving sideways on the chart except for yesterday when the stock jumped 10% to $0.088 per share on a higher than average volume of 400 thousand. This happened after the company announced that it had acquired the customer base of ME-4Free, a US based online natural male enhancement products community.

After the promotion, NUVI may see an even higher trading activity directed towards its stock but it is not certain whether this will be to the benefit of the company’s stock value as no one knows what the intentions of the third parties behind the promotion are.

NUVI is a direct marketing corporation which specializes in health and wellness categories. The company is publicly traded on the OTCQB market where it is currently valued at $3 million.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.