Top Promoted Stocks: REVI, SNTL

Yesterday, US stock markets rebounded after one of their longest negative trading sequences since the start of the year. Apart from being mostly technical in nature, the rally was also supported by the Initial Jobless Claims data, which was slightly better than market’s expectations.

Thus, the US stock markets, including the OTC Market, finished the last trading session colored in green. The OTCM ADR Index climbed 0.86%, or 12.23 points, at 1,437.21. However, despite the positive mood on the OTC Market yesterday, some of the penny stock market movers were struggling with significant selling pressure.

Today, the trading session on the OTC Markets will most likely face thin trading activity which is typical for the last day of the trading week. In general, penny stock promoters are not very active on Friday, so those who speculate with OTC Markets securities will likely experience a more relaxed trading session than usual.

Resource Ventures Inc. (REVI) – The only notable promotion which has been scheduled for today is dedicated on REVI. The campaign is led by Penny Picks, Damn Good Penny Picks, Prepump Stocks and Penny Stock Newsletters.

Resource Ventures Inc. (REVI) – The only notable promotion which has been scheduled for today is dedicated on REVI. The campaign is led by Penny Picks, Damn Good Penny Picks, Prepump Stocks and Penny Stock Newsletters.

Disclaimers did not reveal the names of the third parties but at least it became known that promoters had been compensated $35 thousand for the advertising effort on REVI.

It is interesting to note, that REVI was previously promoted on Aug 8. However, REVI was not a success for its promoters as on the day of the recommendation the stock closed 17% lower at $0.004 per share on a higher than average volume of 2.7 million.

It is interesting to note, that REVI was previously promoted on Aug 8. However, REVI was not a success for its promoters as on the day of the recommendation the stock closed 17% lower at $0.004 per share on a higher than average volume of 2.7 million.

Since then the value of REVI shares kept declining and two days ago the stock hit a 52-week low at $0.0028 per share on a below average volume.

Today, penny stock promoters will once again try to pump the stock. This time, REVI has also provided a helping hand for its stock. The fundamental support for REVI stock came in the form of a press release, which was issued earlier today, saying that the printing industry was facing a bright future ahead.

While, the announcement doesn’t contain any significant value for traders, the promoters of REVI are much more extreme in their vision regarding REVI future. The newsletters’ headlines presented REVI as a “game changer”, “a beast that could run faster than an Olympic sprinter” or “a new sub-penny beast”.

However, since promoters have been compensated to say these words, penny stock speculators must be aware that this fact represents a conflict of interests, which may produce a sinkhole for their investments in REVI.

Seeker Tec International Inc. (SNTL) – Today, penny stock traders will also detect SNTL among the rest promoted OTC Markets securities. Since the last closing bell SNTL has been touted by Premier Equity Reports, Stock Edge, Investor News Source, and Trade These Picks.

Seeker Tec International Inc. (SNTL) – Today, penny stock traders will also detect SNTL among the rest promoted OTC Markets securities. Since the last closing bell SNTL has been touted by Premier Equity Reports, Stock Edge, Investor News Source, and Trade These Picks.

Two of the promoters revealed that they had been sponsored by a third party called Investor News Source, while the rest of the promoters remained silent about the source of their compensation. The campaign itself had cost $5,000.

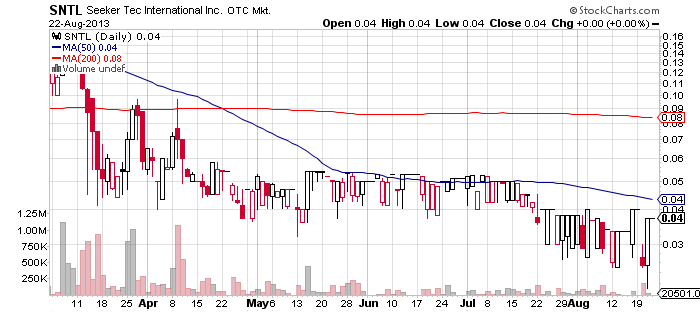

SNTL has not been promoted since May this year. Over this period the stock hasn’t experience any sharp movements. Instead, SNTL has established two price channels:

- From May till July SNTL traded within a range between $0.04 and $0.05

- AT the end of July, SNTL broke below the support at $0.04 and since then it has slid down to a new trading channel between $0.03 and $0.04.

SNTL couldn’t maintain the upper trading channel mostly because the company’s stock has been left without any fundamental support since the beginning of July, when SNTL announced second quarter revenue from its Angolan de-mining operations.

SNTL couldn’t maintain the upper trading channel mostly because the company’s stock has been left without any fundamental support since the beginning of July, when SNTL announced second quarter revenue from its Angolan de-mining operations.

Last Wednesday, the company published its unofficial financial report for the second quarter 2013. However, the trading activity with SNTL stock sharply declined after the issuance of the quarterly report, which revealed a net loss of $170 thousand for the three months ended June 30, 2013.

Perhaps, due to the negative bottom line declared by the company, SNTL got punished this Tuesday, when the stock finally generated a trading volume above the monthly average. On the same day, SNTL shares fell 37% to $0.025 per share on a volume of 179 thousand.

SNTL regained ground on the following day by rising 46% to $.37 per share, but the trading volume was three times lower than the monthly average.

So, with the promotional campaign at hand, SNTL may continue to post similar extreme swings, much to the horror of risk averse penny stock traders.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.