The US stock markets are rallying today after a series of good fundamental news. To a certain extent the current up-move of the stock markets is corrective in nature, as the rally comes after a series of strongly negative sessions and at the moment investors are taking profits from short positions.

On the other hand, the risk appetite on the US stock markets has been provoked by the positive economic data which was published today. First, it was announced that the number of Initial Jobless Claims for the previous week has decreased to 305 thousand, whereas the market expected an increase to 335 thousand.

Second, the third estimate for the Q2 GDP showed a growth rate of 2.5%, which is exactly what the market expected. On this background, the US benchmark indexes are rising in the first half of the trading session.

A positive mood is also present on the OTC Markets, as the OTCM ADR Index is also going up today and at the moment it is positioned at 1,515.32 points, which is 0.21% higher than the previous close.

Thanks to the bullish mood on the OTC Markets, there are numerous penny stocks market movers colored in green today which may present opportunities for speculation:

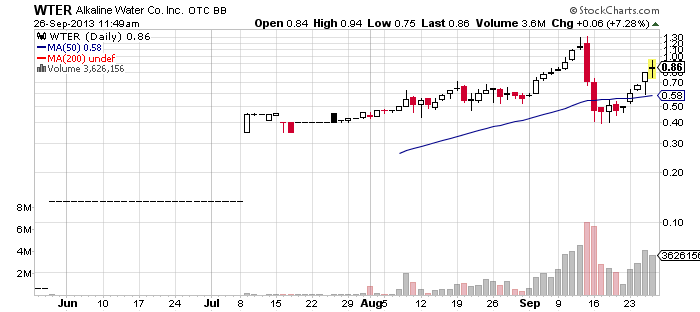

Alkaline Water Company Inc. (WTER) – For the last couple of trading sessions WTER has been recovering from the big plunge in mid-September, when the stock crashed down from $1.30 to $0.40 per share in a matter of just two days.

Alkaline Water Company Inc. (WTER) – For the last couple of trading sessions WTER has been recovering from the big plunge in mid-September, when the stock crashed down from $1.30 to $0.40 per share in a matter of just two days.

WTER has been building momentum since the start of the week. On Monday the stock broke above the 50-MA on a higher than average volume. In the following days the up-move of WTER stock was supported by a couple of press releases.

WTER has been building momentum since the start of the week. On Monday the stock broke above the 50-MA on a higher than average volume. In the following days the up-move of WTER stock was supported by a couple of press releases.

Thus, WTER managed to recover part of its value this week. Yesterday the stock jumped 20% to $0.80 per share on a higher than average volume of 4 million, after WTER got once again featured in a trade alert issued by Growing Stock Report.

The momentum of WTER goes on today. At the moment shares of WTER common stock are trading 9% higher at $0.87 per share on a higher than average volume of 3 million.

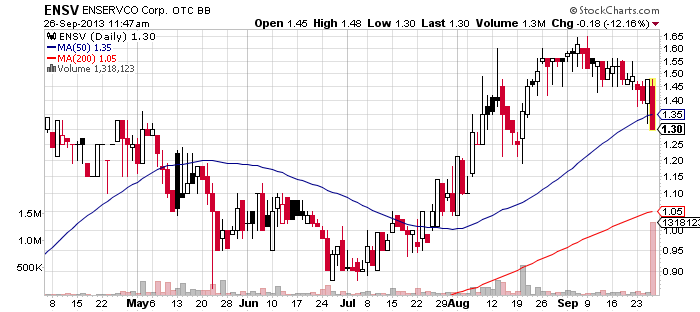

Enservco Corp. (ENSV) – ENSV is tanking under heavy selling pressure today. The stock has been gradually sliding down since it hit a 52-week high at $$1.65 earlier in September.

Enservco Corp. (ENSV) – ENSV is tanking under heavy selling pressure today. The stock has been gradually sliding down since it hit a 52-week high at $$1.65 earlier in September.

Today, however, the decline of the stock is more ostentatious, as it is happening on a trading volume twenty times higher than the monthly average. The explosion in trading volume was most likely promoted by an insider activity which was officially reported yesterday.

Today, however, the decline of the stock is more ostentatious, as it is happening on a trading volume twenty times higher than the monthly average. The explosion in trading volume was most likely promoted by an insider activity which was officially reported yesterday.

A Form 4 filed by ENSV showed that the company’s CEO, Herman Michael, had sold 2.3 million shares of its beneficial ownership at $1.25 on Monday this week. This insider sell-out gave tone to an avalanche of sales orders today. Thus, at the moment shares of ENSV stock are trading 12% lower at $1.30 per share on a higher than average volume of 1.3 million.

This Saturday the company announced the opening of its operations center in Killdeer, North Dakota. This news release, however, failed to prevent the decline of ENSV stock value.

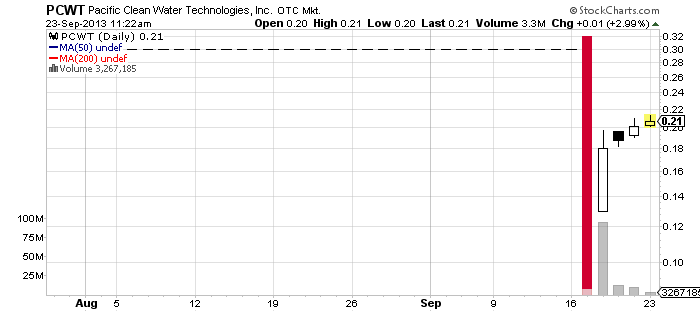

Pacific Clean Water Technologies, Inc. (PCWT) – The black marked PCWT has been issuing press releases like hot bread this week. Yet, the company’s share price reacted stubbornly to the fundamental support and remained relatively flat throughout the week.

Pacific Clean Water Technologies, Inc. (PCWT) – The black marked PCWT has been issuing press releases like hot bread this week. Yet, the company’s share price reacted stubbornly to the fundamental support and remained relatively flat throughout the week.

The fluctuations of PCWT stock value did not exceed 2% this week. This rule is in full power today as well, regardless of the fact that PCWT received another dose of market awareness assistance when it got featured in a trade alert by Growing Stock report.

The fluctuations of PCWT stock value did not exceed 2% this week. This rule is in full power today as well, regardless of the fact that PCWT received another dose of market awareness assistance when it got featured in a trade alert by Growing Stock report.

Currently shares of PCWT stock are trading 2% higher at $0.20 per share on a lower than average volume of 6.7 million. The trade value generated by PCWT so far has reached $1.38 million, which is one of the highest on the OTCQB market.

So far, investors doesn’t seem to get concerned with the company’s caveat emptor status on the OTC Markets, so they continue to provide support for PCWT stock. Thus, for more than a week now PCWT has been consolidating around $0.20 per share championing a market capitalization of $60 million.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.