Shortly before the long awaited briefing of the Federal Open Markets Committee the US stock markets are groping about, unable to find a solid direction. In fact, speculations about the eventual decreasing of Fed’s monetary easing program have been one of the major driving forces on the US markets for the last couple of months.

Later during the day, the FOMC is expected to provide more clarity regarding the bond-buying program. In this regards, there are two scenarios:

- If Fed cuts the program by less than $5 billion per month, the impact on the markets will be negligible.

- If Fed cuts the program significantly, the US stock markets are in for sale-outs.

In light of this, investors have paid little attention to the rest fundamental news scheduled for release today. One hour before the opening bell, it turned out that the Housing Starts in August were lower than market expectations.

In this transitional situation, the US benchmark indexes are currently affected by moderate selling pressure. The OTC Markets, however, are trading slightly above the previous close, as the OTCM ADR Index is up 0.05% at 1,494.21 points.

Pacific Clean Water Technologies, Inc. (PCWT) – Curiously enough, the number one market mover on the OTCQB Markets today is PCWT, an environmental services company whose stock started trading just yesterday.

Pacific Clean Water Technologies, Inc. (PCWT) – Curiously enough, the number one market mover on the OTCQB Markets today is PCWT, an environmental services company whose stock started trading just yesterday.

Today, the stock has exploded both in terms of price and volume. Currently shares of PCWT stock are trading 126% higher at $0.197 per share on a volume of 70 million. So far more than $11.3 million have been exchanged in a total of 2670 transactions with PCWT stock.

What is interesting here is that the company has barely made its first trading steps before it got stamped with a caveat emptor sign. These days it seems that the OTC Markets are getting more prompt in their reactions to suspicious stock movements.

What is interesting here is that the company has barely made its first trading steps before it got stamped with a caveat emptor sign. These days it seems that the OTC Markets are getting more prompt in their reactions to suspicious stock movements.

However, it looks like the black sign has not disturbed market speculators as the stock kept receiving a lot of buying pressure during the day. The reason for the high interest towards the stock is the market awareness campaign on PCWT which was started today at the beginning of the trading session.

The campaign is led by Penny Stock Heroes and Select Penny Stocks, who disclosed a compensation of $500,000 but did not disclose the providers of the money. On the whole, this promotion is the only reason PCWT is stirring today, as there has been no fundamental news from the company which could have produced such a hype.

In fact, it is this same lack of corporate news combined with the promotional activities around the stock, which have provoked the OTC Markets to label the company with a caveat emptor sign. This is part of OTC Markets’ efforts to reduce penny stock scams, which have gone rampant these days.

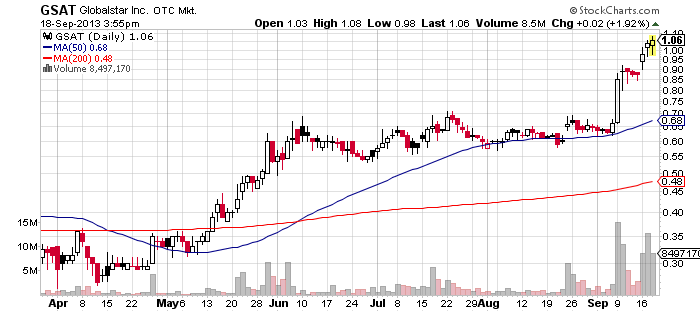

Globalstar, Inc. (GSAT) – GSAT is heavily traded today. The stock has been regularly ranking high on the OTC Markets’ most active list thanks to the continuous fundamental support provided by the company and the trade alerts coming from market awareness initiatives.

Globalstar, Inc. (GSAT) – GSAT is heavily traded today. The stock has been regularly ranking high on the OTC Markets’ most active list thanks to the continuous fundamental support provided by the company and the trade alerts coming from market awareness initiatives.

Today, the stock was trading below the previous close in the first half of the trading session, but after the markets got boosted by the FOMC announcement, the stock quote of GSAT turned green. Thus, at the moment shares of GSAT stock are trading 1% higher at $1.05 per share on a higher than average volume of 7 million.

Today, the stock was trading below the previous close in the first half of the trading session, but after the markets got boosted by the FOMC announcement, the stock quote of GSAT turned green. Thus, at the moment shares of GSAT stock are trading 1% higher at $1.05 per share on a higher than average volume of 7 million.

The trade value generated by GSAT today has reached $7 million which is the third highest on the OTCQB markets today.

At present the company is chasing a market value of over $424 million after just hitting an all-time high at $1.06 per share. With such an inflated market cap for a company which is still posting considerable quarterly losses, and the stock price deviating considerably from its short-term moving averages, GSAT may soon enter a correction phase.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.