Xumanii (XUII) – Yesterday’s rally of XUII was only short lived because today shares of XUII stock are once again tanking under a heavy selling pressure.

Xumanii (XUII) – Yesterday’s rally of XUII was only short lived because today shares of XUII stock are once again tanking under a heavy selling pressure.

In fact today XUII received fundamental support by several press releases concerning the company. The first press release announced that XUII was placed on FINRA’s Daily List and was to receive a notice of effectiveness for name and CUSIP change.

The second press release announced that today would be the first live broadcast event of hip-hop superstar Mac Miller which would air live from Denver, Colorado and would be available to all Xumanii subscribers.

Another press release also informed that XUII had been added to the OTC Stock Watch List at Growing Stock Report. So with this fundamental support at hand, XUII started today’s trading session with a gap up at $0.384 but less the an hour after the opening bell, XUII stock tanked under a heavy selling pressure.

Thus, shares of XUII stock are currently trading 6% lower at $0.348 on a volume of 16.2 million which is close to the monthly average. Intraday penny stock traders are most likely keeping a close eye to the stock’s 50-MA which has served as a support today and will give important trading signals should XUII interact more closely with it.

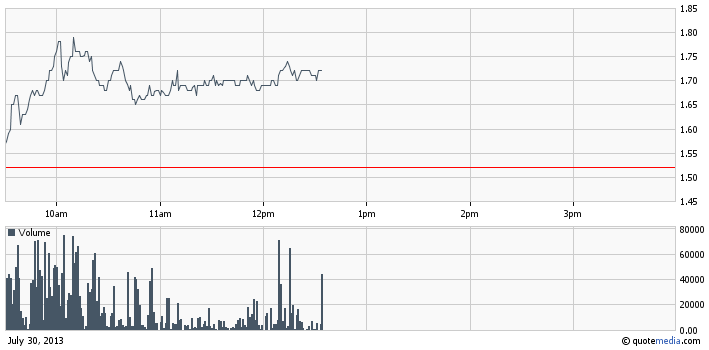

Affymax, Inc. (AFFY) – AFFY stock continues its rally from yesterday without any significant fundamental support. The only press release which appeared on the OTC Disclosure and News Service concerning AFFY announced that Growing Stock Report had included AFFY stock in its OTC Stock Watch List along with XUII, SOUL and PMCM.

Affymax, Inc. (AFFY) – AFFY stock continues its rally from yesterday without any significant fundamental support. The only press release which appeared on the OTC Disclosure and News Service concerning AFFY announced that Growing Stock Report had included AFFY stock in its OTC Stock Watch List along with XUII, SOUL and PMCM.

So without any significant announcements at hand AFFY is currently registering a strong trading session reaching almost $5.4 million in trade value.

So without any significant announcements at hand AFFY is currently registering a strong trading session reaching almost $5.4 million in trade value.

Currently, shares of AFFY stock are trading 13% higher at $1.72 per share on a below average volume of 3.1 million. Yesterday, the stock closed the session at $1.52, up 5%, on a volume of 2.6 million shares.

With this move AFFY has widened the distance from its 50-MA and the next critical point, which penny stock traders should keep an eye on, is the critical $2 level where a couple of months ago AFFY met significant resistance.

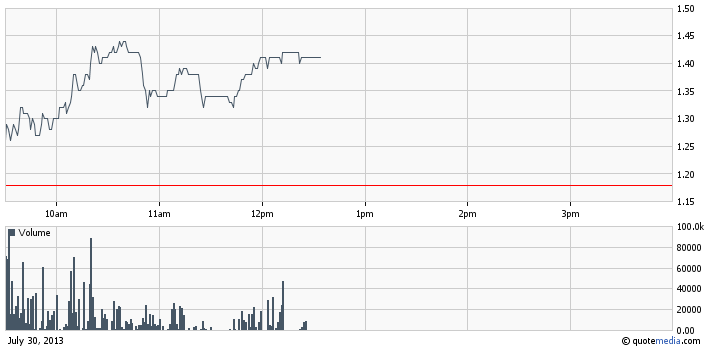

Soul and Vibe Interactive Inc. (SOUL) – Today SOUL is once again climbing up the charts which may seem surprising after yesterday’s negative session.

Soul and Vibe Interactive Inc. (SOUL) – Today SOUL is once again climbing up the charts which may seem surprising after yesterday’s negative session.

At the moment shares of SOUL stock are trading 19% higher at $1.4 per share on a five times higher than average volume of 2 million. The total trade value generated by SOUL today has reached $2.8 million making it one of the top market movers on the OTC Market.

As we said today, the stock is trading without any significant fundamental support as the only press release concerning the company was about SOUL stock ticker being included in the OTC Stock Watch List at Growing Stock Report.

As we said today, the stock is trading without any significant fundamental support as the only press release concerning the company was about SOUL stock ticker being included in the OTC Stock Watch List at Growing Stock Report.

It is possible that the market is making a delayed reaction to yesterday’s announcement that SOUL’s CEO had decided to cancel 64 million shares of his beneficial ownership in the company. Yesterday, despite the news, SOUL stock tanked down 20% on a heavy trading volume most likely due to accumulated profit taking impulses on the market.

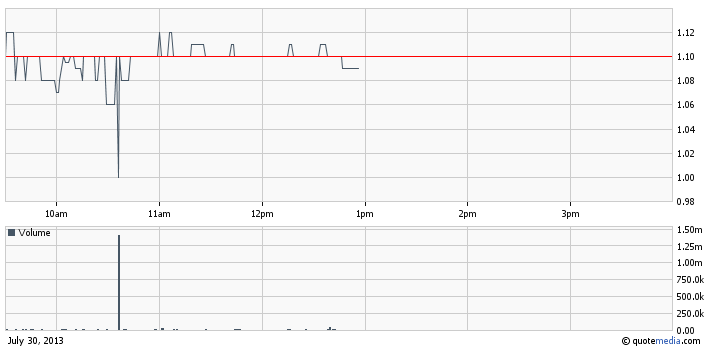

diaDexus, Inc. (DDXS) – DDXS broke out last week after it was announced that the company was going to host a conference call and webcast on August 8 to review second quarter fiscal results.

diaDexus, Inc. (DDXS) – DDXS broke out last week after it was announced that the company was going to host a conference call and webcast on August 8 to review second quarter fiscal results.

Since the break out, DDXS stock value has risen from $0.85 to $1.09 per share. Earlier today, the stock hit a new 52-week high at $1.10 per share but at the moment it is trading below the previous close.

Currently shares of DDXS stock are trading 1% lower at $1.09 per share on a much higher than average volume of 1.7 million.

Currently shares of DDXS stock are trading 1% lower at $1.09 per share on a much higher than average volume of 1.7 million.

DDXS is a pharmaceutical company which focuses on proprietary cardiovascular products targeting unmet needs in cardiovascular disease. The company has a market capitalization of $59.6 million and a 52-week range of 1.10 – 0.28.

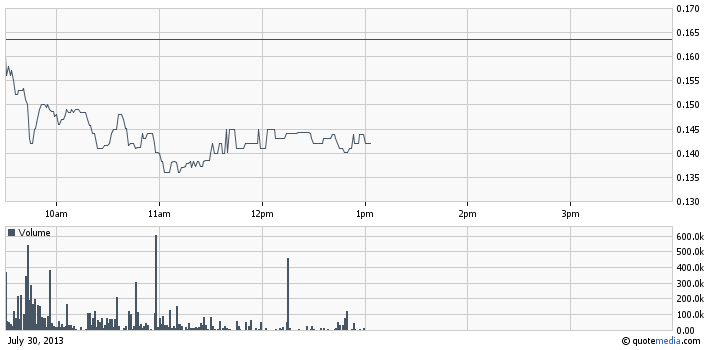

Liquidmetal Technologies, Inc. (LQMT) – The demand for LQMT shares has been cooling in the last couple of days after investors have come to realize the speculative nature of the recent explosion of LQMT stock.

Liquidmetal Technologies, Inc. (LQMT) – The demand for LQMT shares has been cooling in the last couple of days after investors have come to realize the speculative nature of the recent explosion of LQMT stock.

Currently shares of LQMT stock are trading 13% lower at $0.142 per share on a higher than average volume of 10.2 million. The free fall of LQMT stock value, which began at the beginning of last week, has been supported by profit taking impulses and the lack of fundamental support.

These factors has played their role in the recent correction of LQMT which, in short, has driven the stock down from $0.23 to $0.14 per share over the course of one week.

These factors has played their role in the recent correction of LQMT which, in short, has driven the stock down from $0.23 to $0.14 per share over the course of one week.

As we have already reported, the recent spike of LQMT stock was provoked by a press release which concerned the probability for Apple Inc. to increase its usage of LQMT’s liquid metal in the future.

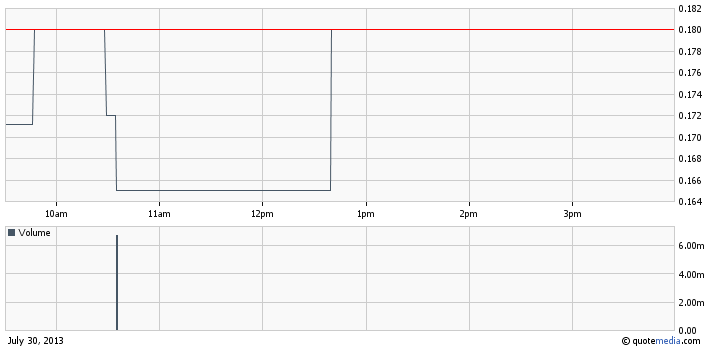

Vasomedical, Inc. (VASO) – VASO is experiencing a sharp volume spike today. Currently shares of VASO stock are trading flat at $0.18 per share on a volume of 6.7 million, which is almost a hundred times higher than the monthly average.

Vasomedical, Inc. (VASO) – VASO is experiencing a sharp volume spike today. Currently shares of VASO stock are trading flat at $0.18 per share on a volume of 6.7 million, which is almost a hundred times higher than the monthly average.

What is curious in this case is that, VASO has already generated a trade value of $1.1 million but there have been only five trades since the opening bell.

This peculiar movement in the volume of VASO stock is happening without any fundamental support as there hasn’t been any official press releases or filings by the company for the last month. Online databases do not show any promotions dedicated to the company either.

This peculiar movement in the volume of VASO stock is happening without any fundamental support as there hasn’t been any official press releases or filings by the company for the last month. Online databases do not show any promotions dedicated to the company either.

VASO is a medical technology company which focuses on the manufacture and sale of medical devices and the domestic sale of diagnostic imaging products. VASO stock has been trading in a firm price range between $0.16 and $0.18 per share since the start of the year. The company has a market cap of $29.3 million and a 52-week trading range of 0.26 – 0.10.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.