Today, investors’ appetite for risk is wavering after it was announced that Durable Orders had declined in July by 7.3%, while the market expected a decline of 4.3%. On this back ground, the US stock markets experienced a bout of selling pressure for a couple of minutes after the opening bell.

However, the US benchmark indexes recuperated a little bit and at the moment they are trading above the previous close. The situation on the OTC Markets, however, is strongly bearish as the OTCM ADR Index has declined 0.25% to 1,441.39.

Despite the corrective mode of the OTC Markets some of our well known penny stock market movers are enjoying green colored quotes today.

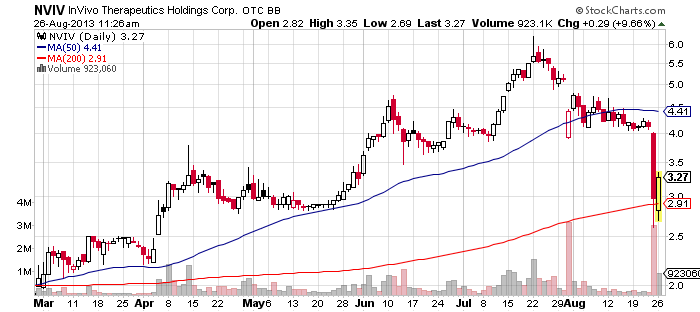

InVivo Therapeutics Holdings Corp (NVIV) – NVIV has been getting back on track, after a disastrous session on Friday when the stock lost 28% of its value on a much higher than average volume.

InVivo Therapeutics Holdings Corp (NVIV) – NVIV has been getting back on track, after a disastrous session on Friday when the stock lost 28% of its value on a much higher than average volume.

On Friday NVIV was swiped by an avalanche of sales orders after an 8-K form, published on the previous day, announced that Francis Reynolds had tendered his resignation as Chief Executive Officer and Director of NVIV due to his medical condition.

This announcement unlocked investors’ fears who rushed the stock downhill causing it to close at $3.00 per share after opening at $4.00 per share. In fact, NVIV has been facing troubles to contain its stock value ever since it hit a 52-week high at $6.20 per share on mid-July.

This announcement unlocked investors’ fears who rushed the stock downhill causing it to close at $3.00 per share after opening at $4.00 per share. In fact, NVIV has been facing troubles to contain its stock value ever since it hit a 52-week high at $6.20 per share on mid-July.

Pennystockgenius has been keeping a close eye on NVIV stock for the last couple of months, as it has been one of the top marker movers on the OTC Markets. During this time, we couldn’t help noticing the constant flow of shares of NVIV stock which Franc Reynolds was regularly dumping on the market.

Therefore, if we may somehow worry about Mr. Reynolds’ health condition, there is no need to worry about his financial state. The same is valid for the new interim CEO of the company called Michael Astrue because, as the SEC filing shows, he is going to receive a generous salary and bonuses for his services.

In other words, the 8-K filing reported that Mr. Astrue would receive a salary at an annual rate of $480,000, plus a cash bonus equal to 50% of his total salary, which is subject of his performance of specified objectives.

It is not clear whether the resignation of MR. Raynolds, or the excessive remuneration of NVIV’s new CEO was the reason investors panicked on Friday, but the truth lies somewhere in the 8-K form as there has been no other fundamental factors which could have catalyzed such a sharp movement in NVIV stock price.

Anyway, after the big plunge on Friday, NVIV stock is rallying today on a higher than average volume. Currently shares of NVIV stock are trading 7% higher at $3.20 per share on a volume of 711 thousand. The trade value generated by NVIV today has exceeded $2.17 million, which is the reason why NVIV is crowning the OTCQB penny stock market movers list.

Affymax, Inc. (AFFY) – Today, AFFY is another penny stock which acts contrary to the OTCM ADR Index, as the stock has registered a second consecutive trading session in the green. Moreover, AFFY has managed to break above the resistance at $1.75 which may be interpreted as a bullish sign by market speculators.

Affymax, Inc. (AFFY) – Today, AFFY is another penny stock which acts contrary to the OTCM ADR Index, as the stock has registered a second consecutive trading session in the green. Moreover, AFFY has managed to break above the resistance at $1.75 which may be interpreted as a bullish sign by market speculators.

AFFY has been consolidating in a price channel between 1.50 and 1.75 since the beginning of August. During this month, the company provided some fundamental support to its stock when, in the middle of the month, it announced a deal with The Brenner Group Inc. (TBG).

On Aug. 16 AFFY issued a press release saying that it had retained TBG to lead the company through a necessary restructure in the face of the OMONTYS recall. The announcement was accepted well by the market, as AFFY stock managed to surge from the lower to the upper border of its trading channel, to the extent that today market speculators could witness a successful attack by the stock on the resistance.

On Aug. 16 AFFY issued a press release saying that it had retained TBG to lead the company through a necessary restructure in the face of the OMONTYS recall. The announcement was accepted well by the market, as AFFY stock managed to surge from the lower to the upper border of its trading channel, to the extent that today market speculators could witness a successful attack by the stock on the resistance.

Currently shares of AFFY stock are trading 11% higher at $1.90 per share on a below average trading volume of 1.1 million. The trade value achieved by the stock so far is $2.17 million which is one of the highest generated by today’s market movers on the OTCQB markets.

Last week AFFY also announced that it had executed a Seventh Amendment to Lease, which provided for the acceleration of the termination date of the lease agreement for the company’s offices and laboratories in Palo Alto, CA. The press release informed that AFFY had a new headquarters in Cupertino, CA.

The news apparently carried little worth to traders as the same day AFFY stock moved only 0.63% up on a below average volume of 400 thousand.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.