Top Promoted Stocks: ERBB, MKHD, UBQU

Yesterday, the major US stock indexes finished in different directions following the announcement of quarterly results by several big corporations comprising the indexes. The trading session on the OTC Markets was volatile as well.

After trading higher than the previous close in the first half of the session, the OTCM ADR Index tanked under a heavy selling pressure in the second half. Thus, at the end of the day the OTCM ADR Index registered a decline of 0.15% at 1,435.65.

Today, the forthcoming trading session on the OTC Markets will be marked by several big promotional campaigns, which will play their role in shaping the share value of the promoted companies. So, here are the details of the biggest penny stock promotions for today:

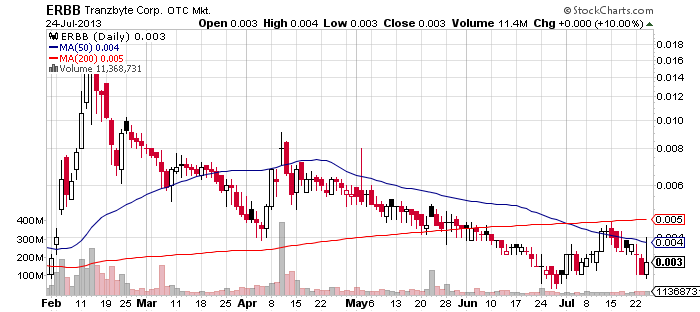

Tranzbyte Corp (ERBB) – The biggest promotion for today in terms of both compensation and number of involved promoters is dedicated to ERBB. The campaign has a serious back-up which is provided by three popular third parties called the Stock Mister, Micro-Cap Consultants and Equity Group LLC. They have provided a cumulative compensation of $75,000 which has been distributed among various promoting groups of websites.

Tranzbyte Corp (ERBB) – The biggest promotion for today in terms of both compensation and number of involved promoters is dedicated to ERBB. The campaign has a serious back-up which is provided by three popular third parties called the Stock Mister, Micro-Cap Consultants and Equity Group LLC. They have provided a cumulative compensation of $75,000 which has been distributed among various promoting groups of websites.

Judging from the scale of the promotion, it is very likely that many penny stock players will wake up today finding their inboxes flooded with newsletters on ERBB issued by Liquid Tycoon, Marketwire Press, Psycho Penny Stocks, Super Hot Penny Stocks and many others.

ERBB was lastly promoted on May 29, but on that day the stock registered a weak performance as its stock remained flat while the trading volume remained below the monthly average. So far ERBB hasn’t issued any new press releases to aid the promotional campaign.

ERBB was lastly promoted on May 29, but on that day the stock registered a weak performance as its stock remained flat while the trading volume remained below the monthly average. So far ERBB hasn’t issued any new press releases to aid the promotional campaign.

The last press release issued by the company dates back to Jul 11, when ERBB announced that it had consolidated its divisions and facilities into a larger facility. On that day ERBB jumped 17% to $0.0042 per share on below average volume of 9 million.

However, since then the share value of ERBB stock has fallen which was signaled in advance by a bearish cross between the moving averages. Thus, ERBB has been heading to its previous support at $0.0027 but on the last trading session the stock made a surprising jump of 10% at $0.0033 per share on a below average volume of 11.3 million.

According to the last unofficial financial report of the company, as of March 31, 2013 ERBB possessed:

- $469 cash and $1 million in total assets (mostly intellectual property)

- $3.2 million in debt and $17.4 million in accumulated deficit

- Zero revenue and $201,000 net loss

Given the reported financial situation of the company, it will not be surprising if market players start to consider ERBB overvalued with its current market cap of $8 million, unless the company’s management finds some alternative ways to convince investors that they have a stable strategy for archiving profits in the near future.

Mount Knowledge Holdings,Inc. (MKHD) – The next big promotion which is going to hit the market today is dedicated to MKHD. The campaign is also sponsored by the Stock Mister who had engaged several stock promoting websites into this campaign , such as The Stock Scout, Penny Stock Players, Penny Stock Pros and so on.

Mount Knowledge Holdings,Inc. (MKHD) – The next big promotion which is going to hit the market today is dedicated to MKHD. The campaign is also sponsored by the Stock Mister who had engaged several stock promoting websites into this campaign , such as The Stock Scout, Penny Stock Players, Penny Stock Pros and so on.

The total compensation received by the promoters sums up to $35,000 for a two-day marketing and promotional effort. MKHD was promoted not long ago, on June 27, but as it is visible by the stock chart that no market activity was registered towards MKHD stock on that day.

On the last trading session, MKHD stock rose 6% to $0.005 on a higher than average volume of 126 thousand.

On the last trading session, MKHD stock rose 6% to $0.005 on a higher than average volume of 126 thousand.

The low trading activity around MKHD is not the only red flag concerning this stock. The fact that the company is marked as limited information on the Pink Sheets is another barrier for attracting more trading activity towards this stock. In this regard, MKHD has not filed any recent financial reports, so with no idea of the company’s financial health, potential investors will have to shoot in the dark if they have to open positions in MKHD stock.

For this reason, the forthcoming promotion on the company will likely face some resistance on the open market unless at least some press release or report sheds more light on the recent developments at MKHD.

Ubiquitech Software Corp. (UBQU) – UBQU is another pink sheets company which has become an object of a stock promotion since the last closing bell. According to online databases, this is the first time the company has been promoted. The campaign is led by only one promoter called Stock Cabin which disclosed a compensation of $10,000 but didn’t reveal the source of the money.

Ubiquitech Software Corp. (UBQU) – UBQU is another pink sheets company which has become an object of a stock promotion since the last closing bell. According to online databases, this is the first time the company has been promoted. The campaign is led by only one promoter called Stock Cabin which disclosed a compensation of $10,000 but didn’t reveal the source of the money.

UBQU cannot boast with a huge trading interest towards its stock. The average monthly volume generated by UBQU stock is only 33 thousand. The company has exceeded the average volume only two times since the start of the month.

The first time was on July 18 when UBQU stock fell 16% to $0.38 per share on a volume of 75 thousand. The second time was on July 9 when the company announced that it had acquired Blue Crush Marketing Group LLC as part of its plan for global expansion.

The first time was on July 18 when UBQU stock fell 16% to $0.38 per share on a volume of 75 thousand. The second time was on July 9 when the company announced that it had acquired Blue Crush Marketing Group LLC as part of its plan for global expansion.

On that day UBQU rose 2% to $0.45 per share on a volume of 47 thousand. In any case UBQU do not generate significant trading interest towards its stock, so if the new promotional campaign on the company manages to catch the attention of market speculators, it can see a more intensive trading today. However, since there has been only one newsletter issued so far as part of the promotion, it can be doubted if UBQU will manage to become an exciting trade in the next couple of days.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.