Top Promoted Stocks: FDFT, SFPI

Last Friday, the US benchmark indexes once again grappled with a heavy selling pressure which forced them to finish the trading session on a bearish land. Thus, the major US stock indexes registered their highest weekly loss since June, this year.

At this stage the downward correction seems natural given the fact that the US stock markets are at historic highs. Investors are taking back profits without paying much attention to fundamental news. Speculations that the Fed may exit the monetary easing policy have already been processed in June, so presently the stock market is driven mostly by technical factors.

From this point of view, many analysts expect that the up-trend will renew when investors come back from their vacations and inject more liquidity in the markets.

As regards the performance of the micro-cap segment of the stock market, it must be said that the OTC Markets, where most of the penny stocks trade, performed in contrast to the general market mood and on Friday the OTCM ADR Index registered a modest increase of 0.13% at 1,453.38. In fact the last trading session for the OTCM ADR Index was rather volatile, as it oscillated several times above and below the previous close before bulls finally managed to get the upper hand on the index.

This was a small ray of light for penny stock speculators, as the increase of the OTCM ADR Index may make investors more prone to take risks in the forthcoming session. During the weekend, the appetite for risk on the OTC Markets has also been stimulated by several significant penny stock promotions, which we are going to examine below:

Foodfest International 2000, Inc. (FDFT) – FDFT stands on the frontline of today’s top promoted stocks as the company has been featured in an expensive marketing awareness campaign which has involved nine penny stock newsletters.

Foodfest International 2000, Inc. (FDFT) – FDFT stands on the frontline of today’s top promoted stocks as the company has been featured in an expensive marketing awareness campaign which has involved nine penny stock newsletters.

The promoting websites which have been touting FDFT since yesterday afternoon are Penny Stocks Profile, Nathan Gold, Club Penny Stocks, Stock Publisher, Penny Stock Crew, The Stock Wizards and others.

The campaign had been backed up by three third parties called ODD Marking LLC, Izoom Entertainment LLC and IPO Awareness. According to online databases, the cumulative sum invested in this campaign adds up to $56,500.

It must also be noted that this is the first time FDFT gets promoted and given that FDFT does not generate significant trading activity, the promotion may have an unpredictable effect on the stock today. Truth be told, FDFT has barely generated any trades recently but what catches the eye is that FDFT registered very sharp movements on the last two trading sessions.

It must also be noted that this is the first time FDFT gets promoted and given that FDFT does not generate significant trading activity, the promotion may have an unpredictable effect on the stock today. Truth be told, FDFT has barely generated any trades recently but what catches the eye is that FDFT registered very sharp movements on the last two trading sessions.

Thus, on Thursday last week, FDFT soared 20% on one single lot of 5000 shares valued at $300. The next day, the stock plunged down 16% completely wiping the gains from Thursday so the stock finished at $0.05 per share on a volume of 100 thousand.

Earlier today FDFT announced that it had completed the acquisition of Restore Force Inc., a provider of residential and commercial restoration services, for the exchange of FDFT’s common stock. The press release want on saying that FDFT would also adopt the business plan of Restore Force Inc.

FDFT is a company providing damage restoration and re-construction services. It is publicly traded on the OTC Pink Current Information Market where the company has a market capitalization of $29 million and a 52-week range of 0.06 – 0.02.

Santa Fe Petroleum, Inc. (SFPI) – A serious onslaught of paid newsletters dedicated to SFPI has been hitting investors’ in-boxes since yesterday afternoon. There have been nearly two dozens of penny stock promoters involved in this campaign.

Santa Fe Petroleum, Inc. (SFPI) – A serious onslaught of paid newsletters dedicated to SFPI has been hitting investors’ in-boxes since yesterday afternoon. There have been nearly two dozens of penny stock promoters involved in this campaign.

Most of the newsletters did not disclose the name of their sponsors, yet a few penny stock promoters provided full disclosure which revealed that some of the third parties behind the current campaign on SFPI are GS Media, one22 Media LLC and Microcap Innovations.

These third parties had generously provided $37,000 in order to compensate the numerous promoters involved in the market awareness effort on SFPI.

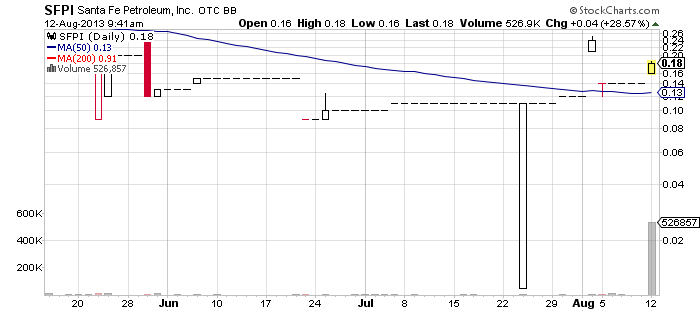

SFPI stock depreciated sharply at the beginning of this year, falling from $2.4 to 10 cents over the course of four months. Since May, however, SFPI has been consolidating within the range of $0.10 and $0.20. Actually, there has been a conspicuous outflow of trading interest towards SFPI stock in the last couple of months, mostly due to the lack of fundamental support provided by the company.

SFPI stock depreciated sharply at the beginning of this year, falling from $2.4 to 10 cents over the course of four months. Since May, however, SFPI has been consolidating within the range of $0.10 and $0.20. Actually, there has been a conspicuous outflow of trading interest towards SFPI stock in the last couple of months, mostly due to the lack of fundamental support provided by the company.

SFPI is a development stage company engaged in the acquisition, exploration and development of oil and gas properties. The company is publicly traded on the OTCQB Markets where it holds a market cap of $5.9 million and a 52-week range of 2.27 – 0.01.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.