Top Promoted Stocks: SRBL, HMLA, CLGZF

Yesterday, the OTCM ADR Index fell 1.85% to 1,317.30 under the influence of the general bearish mood which is currently prevalent on major global markets. However, market players can find opportunities for speculation in any market situation, so trading on the OTC Markets remains as intensive as ever. Today, there are several promoted penny stocks that may fall into the focus of the OTC Markets:

Great American Energy, Inc. (SRBL) – SRBL stands on the frontlines of today’s pre-market promotions. The company has been featured in several newsletters issued by Buzz Stocks, PST Alerts, Penny Pick Finders, Penny Stock Prophet, The Market Caliber Team, 24-7 Stock Alert and Club Penny Stocks. The first two promoters had been compensated $7,000 by Galaxy LLC, and the rest promoters had been compensated $30,000 by Lake Group Media Inc.

Great American Energy, Inc. (SRBL) – SRBL stands on the frontlines of today’s pre-market promotions. The company has been featured in several newsletters issued by Buzz Stocks, PST Alerts, Penny Pick Finders, Penny Stock Prophet, The Market Caliber Team, 24-7 Stock Alert and Club Penny Stocks. The first two promoters had been compensated $7,000 by Galaxy LLC, and the rest promoters had been compensated $30,000 by Lake Group Media Inc.

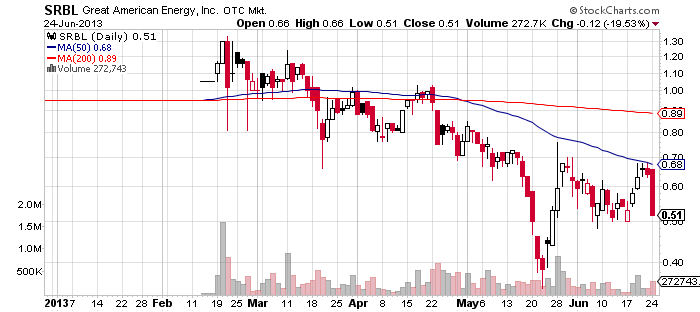

The campaign on SRBL popped up after the company lost 20% of its stock value in a nail-biting session this Monday. SRBL was previously promoted on May 29 when the stock jumped up 14% on a two times higher than average volume.

After the last trading session SRBL failed to penetrate the resistance at $0.70 for a second time in the last 30 days and as a result formed a double top pattern, which is considered a bearish sign by technical traders. Furthermore, the stock continues sliding below its 50-MA and may continue sliding downwards unless the company becomes convincing enough to justify a market capitalization of $46 million.

However, the company hasn’t issued any substantial press release recently which may additionally stimulate the sale-out of SRBL stock.

However, the company hasn’t issued any substantial press release recently which may additionally stimulate the sale-out of SRBL stock.

Yesterday, the company filed a Schedule 14C to officially inform that on May 28, 2013, the Board of Directors had approved several corporate actions, among which:

- A change of the company’s name to “Sovereign Lithium, Inc.”;

- An authorization of 20 million shares of preferred stock;

- A reverse stock split ratio of 1-for-2.

SRBL is a mineral exploration and development company focused on supporting America’s growing clean energy and clean tech industry. Its stock is traded on the OTCQB Market where it holds a market capitalization of $46 million.

Homeland Resources Ltd. (HMLA) – A last minute trade alert issued by the Stock Junction has just started a promotional campaign on HMLA. The trade alert contains an analysis of the company and its prospects provided by John Myers.

Homeland Resources Ltd. (HMLA) – A last minute trade alert issued by the Stock Junction has just started a promotional campaign on HMLA. The trade alert contains an analysis of the company and its prospects provided by John Myers.

According to disclaimers, the campaign had been ordered by a third party called Front Line International, which had received and managed a total production budget of $100,000 for the online campaign on HMLA. John Myers, on his part, had received $7,000 for his analysis on HMLA.

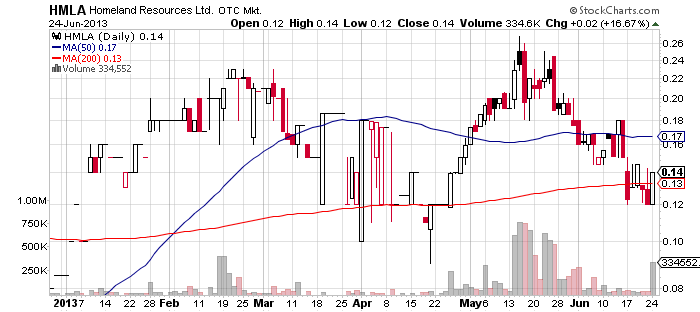

Previously, on May 23rd the company had a much smaller-sized campaign, which finished with a 5% increase in HMLA stock price on a volume five times higher than the monthly average.

In May HMLA also hit a 52-week high at $0.27 per share but over the course of one month it fell down considerably and now trades around its previous support at $0.12 per share. At the beginning of the month HMLA also broke below its 50-MA and is now oscillating around its 200-MA.

In May HMLA also hit a 52-week high at $0.27 per share but over the course of one month it fell down considerably and now trades around its previous support at $0.12 per share. At the beginning of the month HMLA also broke below its 50-MA and is now oscillating around its 200-MA.

In the last trading session, HMLA finished above the slower moving average after it surged 16% to $0.14 per share on a volume of 334 thousand, which is two times higher than the monthly average. This surge in HMLA stock value was supported by a press release which announced that the next two spud dates for drilling at the company’s Liberty Ridge Oil and Gas Project would be on July 1st and July 6th, 2013.

Today, thanks to the press release and the newly initiated market awareness campaign on the company, the demand for HMLA may increase unless there is a conflict of interests behind the current promotion of the company.

HMLA is an onshore oil and gas production and exploration company which is focused on developing oil and natural gas reserves in the US. Its stock is traded on the OTCQB market where the company is currently valued at $8.5 million.

Hutech21 Co., Ltd. (CLGZF) – The group of VIP Penny Stocks and Elite OTC initiated a promotional campaign on CLGZF after the end of the last trading session. The campaign had been ordered by a third party called SNN stocks for the total amount of $22,500.

Hutech21 Co., Ltd. (CLGZF) – The group of VIP Penny Stocks and Elite OTC initiated a promotional campaign on CLGZF after the end of the last trading session. The campaign had been ordered by a third party called SNN stocks for the total amount of $22,500.

CLGZF was promoted last Monday as well, but on that day the stock fell 17% to $0.41 per share on a volume of 1 million which was the second highest in the company’s history. In fact, since mid-May, when CLGZF stock resumed trading on the Pink Sheets market, it has been constantly declining and as of the last trading session, when CLGZF lost another 37% at $0.022 per share, the company’s market capitalization was reduced to $2.7 million.

Apparently neither the press releases issued by the company, nor the continuous promotion of CLGZF stock have been able to win investors’ confidence in a company which has undergone multiple name changes and reverse stock splits in the past and now operates in an unpopular sector in Canada.

Apparently neither the press releases issued by the company, nor the continuous promotion of CLGZF stock have been able to win investors’ confidence in a company which has undergone multiple name changes and reverse stock splits in the past and now operates in an unpopular sector in Canada.

Furthermore, the company had listed a very unprofessionally made website of its wholly owned subsidiary, Prairie Oilfiedl Services Ltd., which claims to be operating since 1996 but the website has been registered only three months ago.

With such confidence gaps at hand, CLGZF may still be perceived as overvalued despite its low current market capitalization. Therefore, it is possible for the stock to find support at its current level but it may also keep losing value, especially if we take in mind the ongoing promotions of CLGZF and the fact that they may serve the not-so-generous interests of clandestine third parties.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.