Yesterday US stock markets managed to overcome the wavering start of the trading session and eventually finished with an increase despite the lack of any important economic news. The rebound of the stock markets was expected as the benchmark US indexes had been declining in three consecutive trades. Therefore, on Thursday investors were closing short positions on the typically thin trade during the peak of the summer.

The highest relative increase for the day was registered by the OTCM ADR Index which climbed 0.74% to 1,451.56. The ascending movement of the OTC Markets was highlighted by the explosive surge of SOYL, which claimed a place among the top market movers yesterday after it skyrocketed a whopping 2,400%. This dumbfounding surge of the recently known-to-nobody stock was produced by a massive promotional campaign.

Today, there is a markedly lower promotional activity, which is not surprising if we consider the fact that this is the end of the trading week. Yet, there are a couple of small promotions issued since the last closing bell, of which we are going to focus on the most speculative one:

Cereplast, Inc. (CERP) – Penny stock promoters have given a second try with CERP’s promotion after the campaign, which was issued yesterday before the opening bell, failed to bolster the company’s stock value.

Cereplast, Inc. (CERP) – Penny stock promoters have given a second try with CERP’s promotion after the campaign, which was issued yesterday before the opening bell, failed to bolster the company’s stock value.

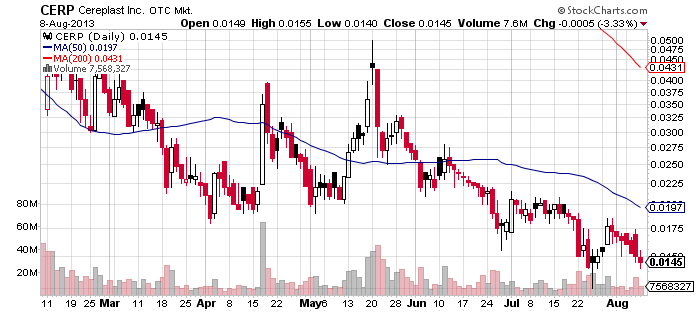

In other words, CERP finished the last trading session 3% lower at $0.0145 per share on below average volume of 7.5 million. The disappointing performance of CERP happened despite the fact that the stock was featured in a promotional campaign, which was initiated by Penny Stock Crowd and Stock Blaster for a compensation of $2,500 provided by EAG Group.

After the end of the last trading session, another group of stock promoters joined the advertising efforts regarding CERP. This group included several well-known promoters, such as Damn Good Penny Picks, Penny Stock Newsletters and Penny Picks.

The third parties behind the new campaign, however, remained anonymous but still it was disclosed that the promoters of CERP had received $25,000 for the market awareness program.

We are yet to see whether this promotion will work out better than yesterday’s one but it is obvious that the campaign will face hard times trying to win back investors’ confidence in CERP stock.

CERP is just about to retest its 52-week low, which was registered in February this year just before the stock exploded to over $0.05 per share on a highly speculative basis. In the course of several months, though CERP has been steadily sinking down to the extent that it has just reached its pre-promotional levels.

CERP is just about to retest its 52-week low, which was registered in February this year just before the stock exploded to over $0.05 per share on a highly speculative basis. In the course of several months, though CERP has been steadily sinking down to the extent that it has just reached its pre-promotional levels.

When the company’s last financial report came out, CERP management tried to manipulate the market by issuing a press release announcing that it had managed to increase revenues by 900%. The company’s revenue had truly jumped up from $124 thousand to $949 thousand in the first quarter of 2013. However, the press release didn’t mention that CERP’s net loss had also increased from $14 thousand to $18 thousand.

In general, CERP’s stock chart, which displays a steady downtrend established by CERP stock, is a reflection of the company’s inability to retain investors’ confidence. Thus, it seems that CERP has preferred to resort to paid market awareness campaigns in order to enliven the waning demand for the stock.

However, this fact will only exacerbate the risk connected with CERP stock, as market speculators have already witnessed the whimsical nature of this company, which was on the verge of default at the beginning of the year.

CERP is a company which designs and manufactures proprietary starch-based and algae-based bio-plastic resins, which aim to become a substitute for the petroleum-based additives. The company is publicly traded on the OTCQB Market where it is currently valued at $6.5 million. CERP has established a 52-week range of 0.347 – 0.0096 and currently holds 448 million shares issued and outstanding, 6 million of which comprise the company’s public float.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.