Top Promoted Penny Stocks: BRWC, MXAM

Yesterday, the US stock markets marked down another strongly positive session in their diaries, as investors’ risk appetite pushed the benchmark indexes higher on the charts. The stock buying spree this week is a result of both the technical rally of the stock markets and the alternative solution to the Syrian crisis.

While the Dow Jones is preparing to attack its 50-MA after rising 0.85% on the last trading session, the OTCM ADR Index posted a much more notable increase. The Index measuring the American Depository Receipts traded on the OTC Markets climbed 18.23 points, or 1.25%, to 1,473.57 during the last trading session.

Today no important economic news are expected, so investors will continue to delve into speculations about the probable scaling down of Fed’s monetary easing program. Penny stock traders will also have to watch the promotional activities which are taking place on the OTC Markets, so below we provide an overview of the most important, newly issued promotional campaigns for today:

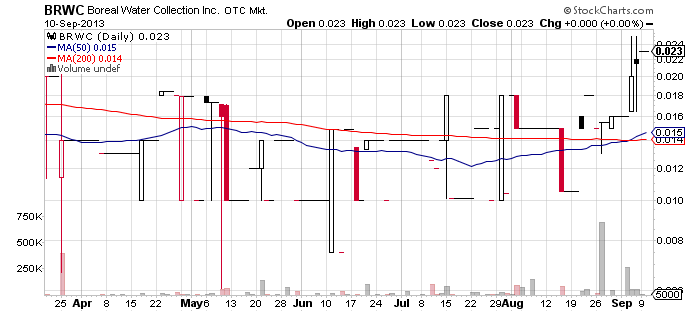

Boreal Water Collection, Inc. (BRWC) – BRWC is a company which cannot make a boast of attracting any significant trading interest. The company’s quote shows an average monthly volume of only 58 thousand shares, which equals a dollar volume of $1,300.

Boreal Water Collection, Inc. (BRWC) – BRWC is a company which cannot make a boast of attracting any significant trading interest. The company’s quote shows an average monthly volume of only 58 thousand shares, which equals a dollar volume of $1,300.

The highest trading activity with this stock within the last 30 days happened on Aug 27, when BRWC generated a trading volume of 683 thousand and a trade value of $10 thousand during the day. This happened shortly before BRWC announced that it had completed its refinancing and reduced its debt by $1.1 million. However, the share price of BRWC stock crawled up only 3% during the day.

Last week BRWC also announced in an 8-K form that it had entered into a $900,000 asset-based loan with Riverdale Funding LLC with a maturity date of Aug 26, 2014. The announcement, however, had a nil effect on the market, as on the same date no trades with BRWC stock were registered.

Last week BRWC also announced in an 8-K form that it had entered into a $900,000 asset-based loan with Riverdale Funding LLC with a maturity date of Aug 26, 2014. The announcement, however, had a nil effect on the market, as on the same date no trades with BRWC stock were registered.

As BRWC kept facing frigid reactions by the market towards its PR efforts, the company apparently have decided to resolve to alternative methods of popularizing its stock. In other words, BRWC had sought the services of stock promoters.

Online databases have registered a newsletter issued by Information Solutions Group touting BRWC. The newsletter’s fine print disclosed that the promoter had received $10,000 by BRWC to market the company.

The trade alert on BRWC was issued one hour before the opening bell and provided no significant new information for penny stock traders to digest. So far during the day BRWC have not issued any press releases to back up the promotion of the company.

Most likely these two facts are the main reason why the campaign has had an anemic effect in the early trading hours, as BRWC had generated a treading volume of only 50,000 which is below the monthly average, while the stock value remains unchanged as compared with the previous close.

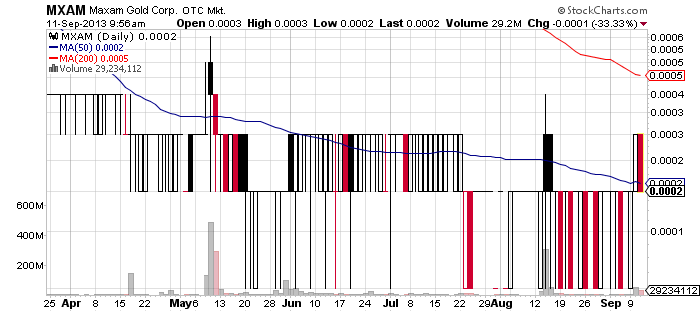

Maxam Gold Corp. (MXAM) – Today, MXAM is the most intensively promoted penny stock company measured by the number of issued newsletters. So far online databases have registered more that 12 newsletters touting MXAM.

Maxam Gold Corp. (MXAM) – Today, MXAM is the most intensively promoted penny stock company measured by the number of issued newsletters. So far online databases have registered more that 12 newsletters touting MXAM.

The campaign on the triple-zero MXAM is led by several well-known promoters, among which Penny Stock General, Stock Runaway, MBSA etc. The cumulative compensation disclosed by the various promoters adds up to $8,500.

In order to back up the market awareness campaign, MXAM also issued a press release earlier during the day. It announced that MXAM had engaged approximately 50 miners in its province in eastern Honduras to explore and perform test production from potential alluvial gold deposits.

In order to back up the market awareness campaign, MXAM also issued a press release earlier during the day. It announced that MXAM had engaged approximately 50 miners in its province in eastern Honduras to explore and perform test production from potential alluvial gold deposits.

As far as MXAM’s promoters are concerned, their efforts to pump the stock boiled down to saying that the stock was at its absolute bottom at $0.0003 per share and there was nowhere for MXAM to go but up. Unfortunately, this was a misleading conception as MXAM fell 33% to $0.0002 per share in the first half of the trading session. That happened on a higher than average volume of 29 million.

Thus, today’s promotion of MXAM was just another example of how deceptive paid newsletter can be. In fact, MXAM is, first, a pink sheets stock and, second, a triple zero stock. These two facts combined produce the riskiest stock trades on the market, so investors will have to carefully estimate their risk tolerance before investing their money in MXAM stock.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.