The US benchmark indexes are heading up at the beginning of today’s trading session , most likely due to profit taking from short positions. Investors’ risk appetite was not spurred by any fundamental news, as at the beginning of the trading session it became clear that Pending Home Sales were down 1.3% for July, while the market expected an increase of 0.2%.

Regardless of the bullish episode on the major US stock exchanges, the OTC Markets continue to struggle with a heavy selling pressure. Currently the OTCM ADR Index is down 0.37% at 1,407.85 points. Thus, most of the penny stock market movers today are colored in red, which means market speculators will face hard times to find a suitable short term micro-cap play.

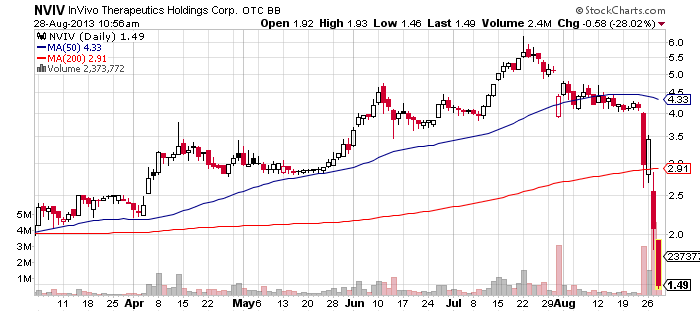

InVivo Therapeutics Holdings Corp (NVIV) – The sale-out nightmare of NVIV stock continues today. NVIV has been quickly losing value in the last couple of days after a couple of recent corporate updates kindled investors’ fears about the company’s future.

InVivo Therapeutics Holdings Corp (NVIV) – The sale-out nightmare of NVIV stock continues today. NVIV has been quickly losing value in the last couple of days after a couple of recent corporate updates kindled investors’ fears about the company’s future.

The first corporate update, which marked the start of NVIV’s fall, announced that the company had canceled the up-listing process. The latest corporate event, which sparked the real plummeting of NVIV stock value, was the resignation of the company’s CEO, Franc Reynolds.

As we have said numerous times in our previous publications, Franc Reynolds would hardly go out of the company into a poorhouse. For, NVIV’s former CEO was releasing steady amounts of his corporate holdings on the open marker while NVIV share price was soaring.

As we have said numerous times in our previous publications, Franc Reynolds would hardly go out of the company into a poorhouse. For, NVIV’s former CEO was releasing steady amounts of his corporate holdings on the open marker while NVIV share price was soaring.

We shouldn’t worry for the finances of the new CEO of NVIV either, as it turned out than Mr. Reynolds’ successor would receive an annual salary of $480 thousand.

Overall, the last press release was the catalyst which sparked an immense selling pressure on NVIV. S, in a matter of only four trading sessions NVIV declined from $4.00 per share to below $2.00 per share.

Currently shares of NVIV stock are trading 26% lower at $1.53 per share on a higher than average volume of 1.5 million. The trade value generated by NVIV so far has reached $2.4 million which is one of the highest values on the OTCQB markets today.

The decline of NVIV could not be hampered by the press releases which came out on the OTC Outside News Sources section concerning NVIV. The first press release announced that NVIV had been featured in a trade alert by OTC Daily Alert. However, the alert turned to be a rather toxic one because the investors who had followed it have most likely been burnt severely.

In addition NVIV tried to provide a helping hand of its stock value by issuing a press release, which announced an update on the clinical timeline for NVIV’s biopolymer scaffolding to treat acute spinal cord injuries. The company also said it expected to enroll its first patient during the first quarter of 2014.

Nevertheless, neither the corporate announcement, nor the trade alert were able to produce enough demand for NVIV stock so as to buffer the piling sale orders for NVIV stock.

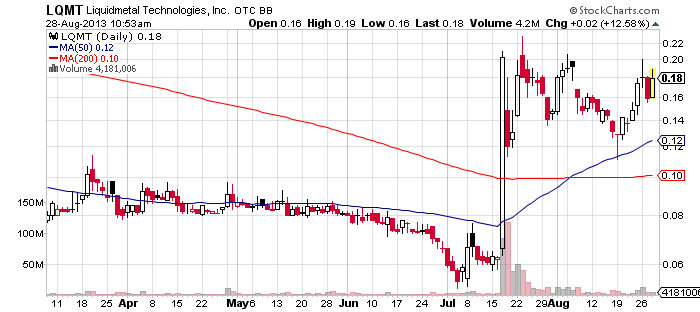

Liquidmetal Technologies, Inc. (LQMT) – LQMT is heading up today despite the fact that the stock has not received any fundamental support recently. LQMT stock is rallying today after yesterday’s decline.

Liquidmetal Technologies, Inc. (LQMT) – LQMT is heading up today despite the fact that the stock has not received any fundamental support recently. LQMT stock is rallying today after yesterday’s decline.

On the last trading session LQMT fell 12% to $0.159 per share on a lower than average volume of 4.2 million. However, today the stock is regaining ground, as it is currently trading 13% higher at $0.179 per share on a volume of 4.2 million.

On the last trading session LQMT fell 12% to $0.159 per share on a lower than average volume of 4.2 million. However, today the stock is regaining ground, as it is currently trading 13% higher at $0.179 per share on a volume of 4.2 million.

The most likely reason why LQMT is supported by investors today, is the fact that the company’s stock ticker was featured in a trade alert by OTC Daily Alerts. The latter had put a target price fo LQMT stock at $0.1798 per share.

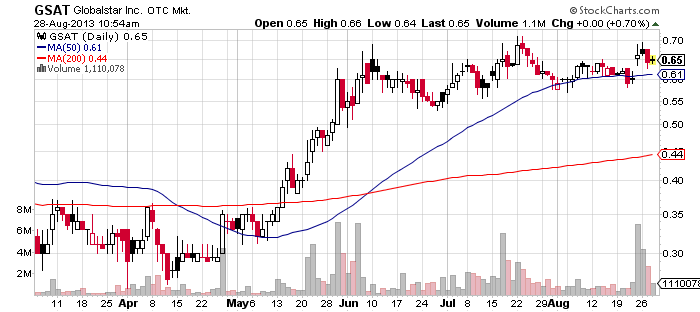

Globalstar, Inc. (GSAT) – Today, GSAT is fiercely struggling to keep its head above the previous close. At the moment the company’s quote is still colored in green but during the day GSAT has exhibited an episodical weakness when its share price dipped to an intraday low at $0.64 per share.

Globalstar, Inc. (GSAT) – Today, GSAT is fiercely struggling to keep its head above the previous close. At the moment the company’s quote is still colored in green but during the day GSAT has exhibited an episodical weakness when its share price dipped to an intraday low at $0.64 per share.

GSAT gained strength to fight with the overwhelming decline of the OTC Markets after it announced to the public that all second generation satellites were in full commercial service, completing “the world’s most modern” satellite communications network.

GSAT’s trading volume exploded on Friday, when the company announced that it had met all of the conditions precedent necessary for the effectiveness of the Amended and Restated COFACE Facility Agreement.

GSAT’s trading volume exploded on Friday, when the company announced that it had met all of the conditions precedent necessary for the effectiveness of the Amended and Restated COFACE Facility Agreement.

On that day GSAT share price jumped 10% to $0.66 per share on a higher than average volume of 6.6 million. Since that day, GSAT has been consolidating and it is now trading at $0.64 per share, up 0.70 percent, on a below average volume of 1.1 million.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.