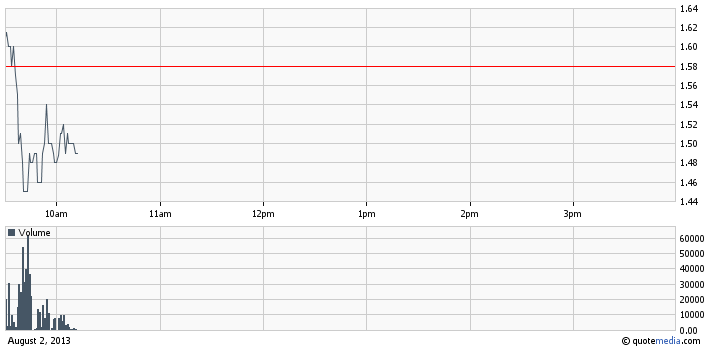

Affymax, Inc. (AFFY) – AFFY stock keeps losing value for a third session in a row. As the stock recently registered a break out which launched the stock way above the 50-MA, it is now technically correcting the distance from the moving average as the described movement happened without any fundamental support.

Affymax, Inc. (AFFY) – AFFY stock keeps losing value for a third session in a row. As the stock recently registered a break out which launched the stock way above the 50-MA, it is now technically correcting the distance from the moving average as the described movement happened without any fundamental support.

In Fact AFFY opened the trading session with a gap-up at $1.62 but it wasn’t long before the stock tanked below the previous close under heavy selling pressure.

At the moment shares of AFFY stock are trading 5% lower at $1.5 per share on a below average volume of 525 thousand. So far AFFY has generated a trade value of $790 thousand which makes it the most actively traded penny stock on the OTCQB market.

Since AFFY stock is unlikely to receive any substantial fundamental support in the coming days, the correction process which drives the stock price closer to its moving average value is likely to continue.

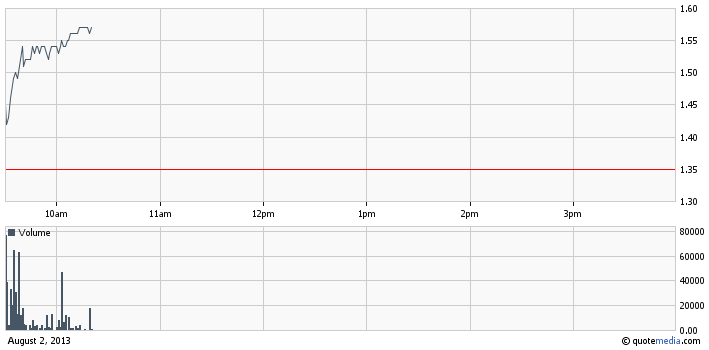

Save The World Air, Inc. (ZERO) – ZERO stock is currently charged by a strong bullish impulse which has resulted in a break out and a new 52-week high for the stock. The stock is supported by a strong buying pressure which was produced by an 8-K filing that was published earlier today.

Save The World Air, Inc. (ZERO) – ZERO stock is currently charged by a strong bullish impulse which has resulted in a break out and a new 52-week high for the stock. The stock is supported by a strong buying pressure which was produced by an 8-K filing that was published earlier today.

Currently shares of ZERO stock are trading 16% higher at $1.57 per share on a five times higher than average volume of 550 thousand. In the first trading hour ZERO generated a trade value of $825 thousand which is one of the highest on the OTCQB markets today.

Currently shares of ZERO stock are trading 16% higher at $1.57 per share on a five times higher than average volume of 550 thousand. In the first trading hour ZERO generated a trade value of $825 thousand which is one of the highest on the OTCQB markets today.

Investors rushed ZERO stock after an 8-K filing announced that ZERO had entered into an Equipment Lease/Option to Purchase Agreement with Trans Canada Keystone Pipeline, which entitled Trans Canada to lease, install, maintain, operate and test the effectiveness of ZERO’s AOT technology and equipment on one of Trans Canada’s operating pipelines.

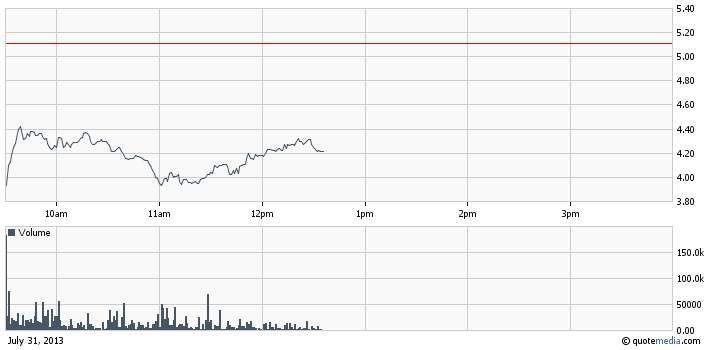

InVivo Therapeutics Holdings Corp (NVIV) – Today NVIV is once again struggling with gravity forces as the stock was not able to continue yesterday’s rally. Two days ago, when NVIV announced it had canceled its up-listing plans, its stock plunged down on a heavy trading volume sinking below the 50-MA.

InVivo Therapeutics Holdings Corp (NVIV) – Today NVIV is once again struggling with gravity forces as the stock was not able to continue yesterday’s rally. Two days ago, when NVIV announced it had canceled its up-listing plans, its stock plunged down on a heavy trading volume sinking below the 50-MA.

On the following day, investors supported the stock which regained 8% of its value on a higher than average volume and finished above the 50-MA. Today however, investors’ mood is quite the opposite so sale orders are prevailing forcing the stock below the previous close.

At the moment shares of NVIV stock are trading 5% lower at $4.5 per share on a lower than average volume of 121 thousand. So far NVIV has generated a trade value of $550 thousand.

At the moment shares of NVIV stock are trading 5% lower at $4.5 per share on a lower than average volume of 121 thousand. So far NVIV has generated a trade value of $550 thousand.

We pointed several times in our previous OTC Markets digests that NVIV’s CEO, Francis Reynolds, had been continuously dumping chunks of his holdings in NVIV on the open market. Two days ago, another Form-4 showed that Mr. Reynolds had not given up profiting from NVIV’s spectacular appreciation. In other words, the company’s CEO had sold 24 thousand shares of NVIV common stock on the open market this week.

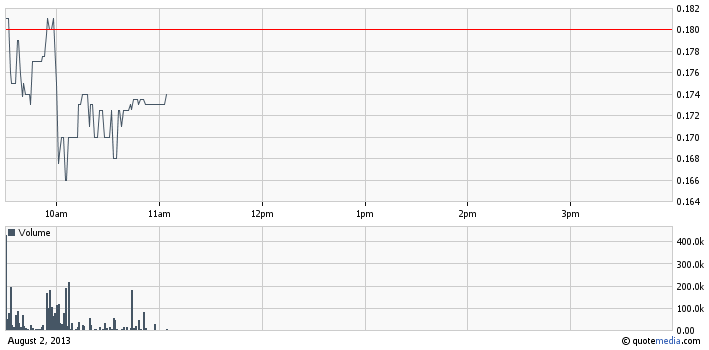

Liquidmetal Technologies, Inc. (LQMT) – Shares of LQMT are once again treading in bearish waters today as the recent speculative hype around the stock starts to cool out.

Liquidmetal Technologies, Inc. (LQMT) – Shares of LQMT are once again treading in bearish waters today as the recent speculative hype around the stock starts to cool out.

At the moment shares of LQMT stock are trading 4% lower at $0.173 per share on a below average volume of 3.3 million. So far LQMT has generated a trade value of $590 thousand which is one of the highest on the OTCQB Markets today.

Yesterday, LQMT stock rallied after market players were informed that the company had scheduled Second Quarter 2013 Earnings Conference Call for Aug 06. On this basis the stock rose 22% to $0.18 per share on a higher than average volume of 12 million.

Yesterday, LQMT stock rallied after market players were informed that the company had scheduled Second Quarter 2013 Earnings Conference Call for Aug 06. On this basis the stock rose 22% to $0.18 per share on a higher than average volume of 12 million.

Today, however, it seems that investors are unwilling to risk with the stock as it is not sure whether LQMT will manage to sustain the new highs which the stock hit mostly due to speculative reasons.

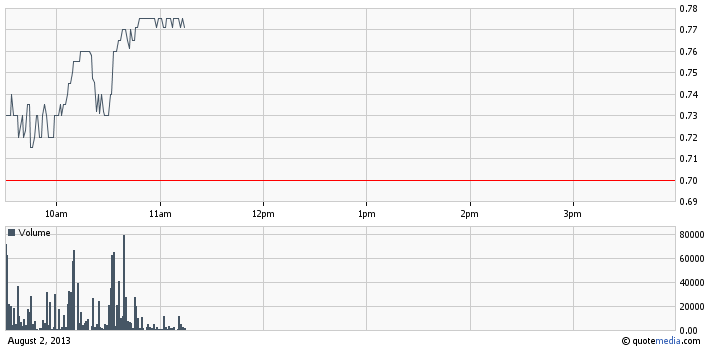

Sanborn Resources, Ltd. (SANB) – The bullish run of SANB stock continues today as it is chasing new historic highs. SANB has been building momentum since it was featured in a trade alert by OTC Daily Alert.

Sanborn Resources, Ltd. (SANB) – The bullish run of SANB stock continues today as it is chasing new historic highs. SANB has been building momentum since it was featured in a trade alert by OTC Daily Alert.

Apart from the promotion there has been no additional fundamental support for SANB stock, yet it has been climbing undisturbedly up the chart for the last couple of days, to the extent that the company has already reach a market valuation of $28 million.

Apart from the promotion there has been no additional fundamental support for SANB stock, yet it has been climbing undisturbedly up the chart for the last couple of days, to the extent that the company has already reach a market valuation of $28 million.

At the moment shares of SANB are trading 11% higher at $0.775 per share on a much higher than average volume of 1.4 million. At this point SANB has also hit a new 52-week high, yet the reasons behind this surge seem rather speculative given that it has been happening without any significant fundamental support.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.

PennyStockGenius.com has a zero tolerance spam policy. All subscribers are opt-in, and can unsubscribe at any time. We will never sell or redistribute your email to any 3rd party.